Opportunities in Direct United States Real Estate for Canadian Institutional Investors

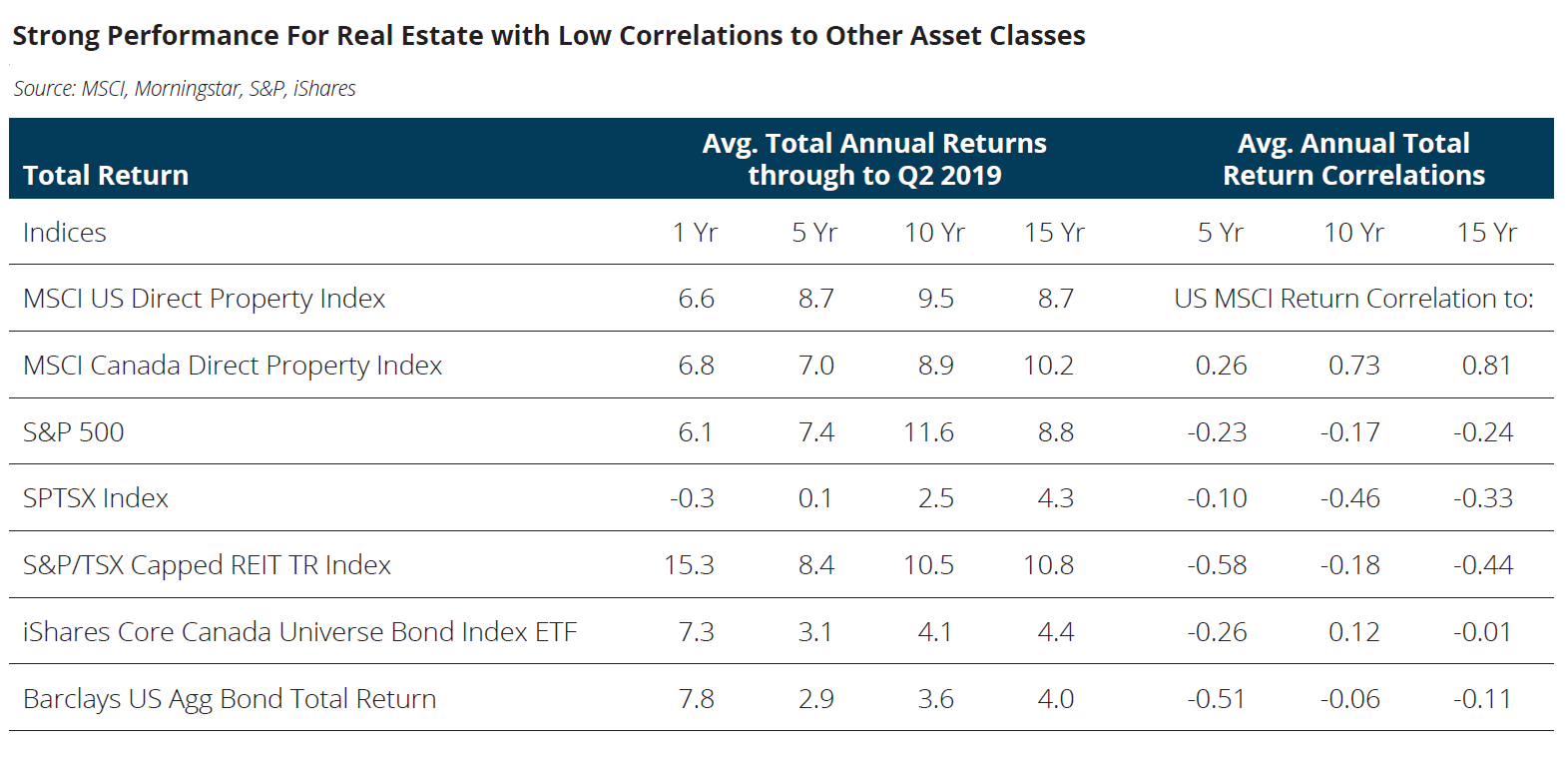

With institutional investors continuing to search for stable, risk-adjusted returns, private real estate has emerged as a desirable asset class given its ability to provide steady cashflows and potential for capital appreciation. With low correlations to public markets, inflation-hedging characteristics and historically lower volatility than public equities, private real estate has also emerged as an asset class with strong ‘beta’ benefits in a mixed-asset portfolio.

To better improve risk diversification, Canadian institutional investors with existing or expanding private real estate allocations can use exposure to the US market, taking advantage of the market’s unique economic drivers and regional differences. Our latest report looks specifically at direct, private equity property investments and particularly ‘core’ income-producing real estate in the US.

Why the US Market for Canadian Investors?

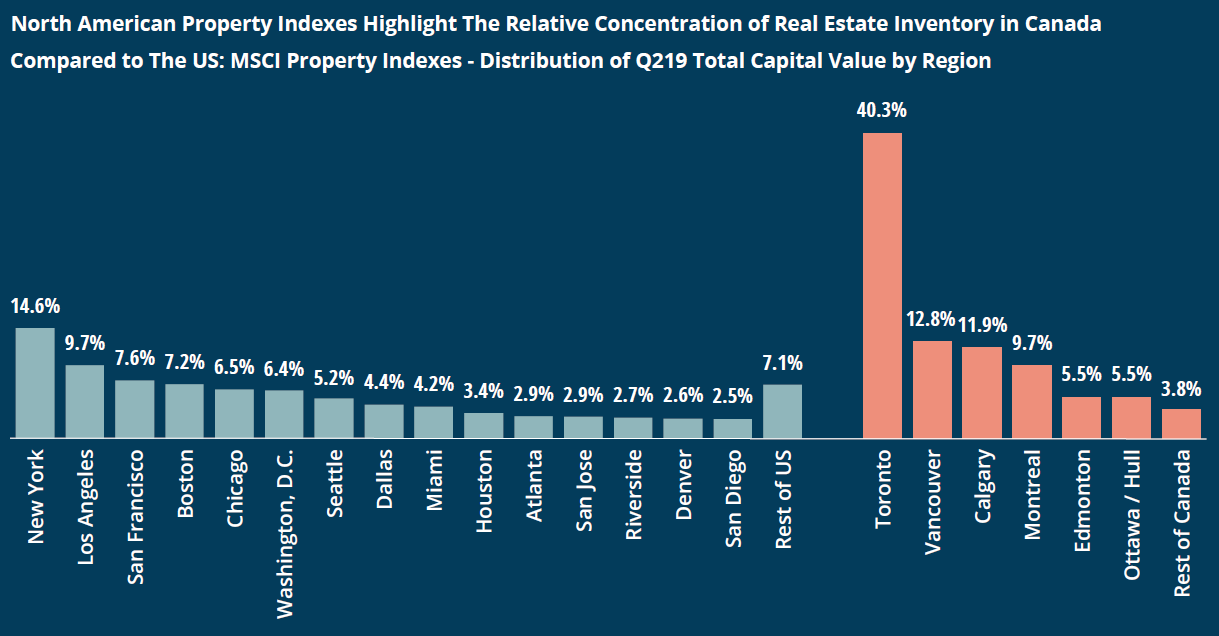

Size, Scale and Liquidity: The US commercial real estate market is the largest in the world with an estimated value of US$3.14 trillion and 40% of the global (professionally managed) real estate market. With more than fifty cities above one million in population, the US is close to ten times larger than Canada. More than US$373 billion is traded annually on average, making it the most liquid markets globally.

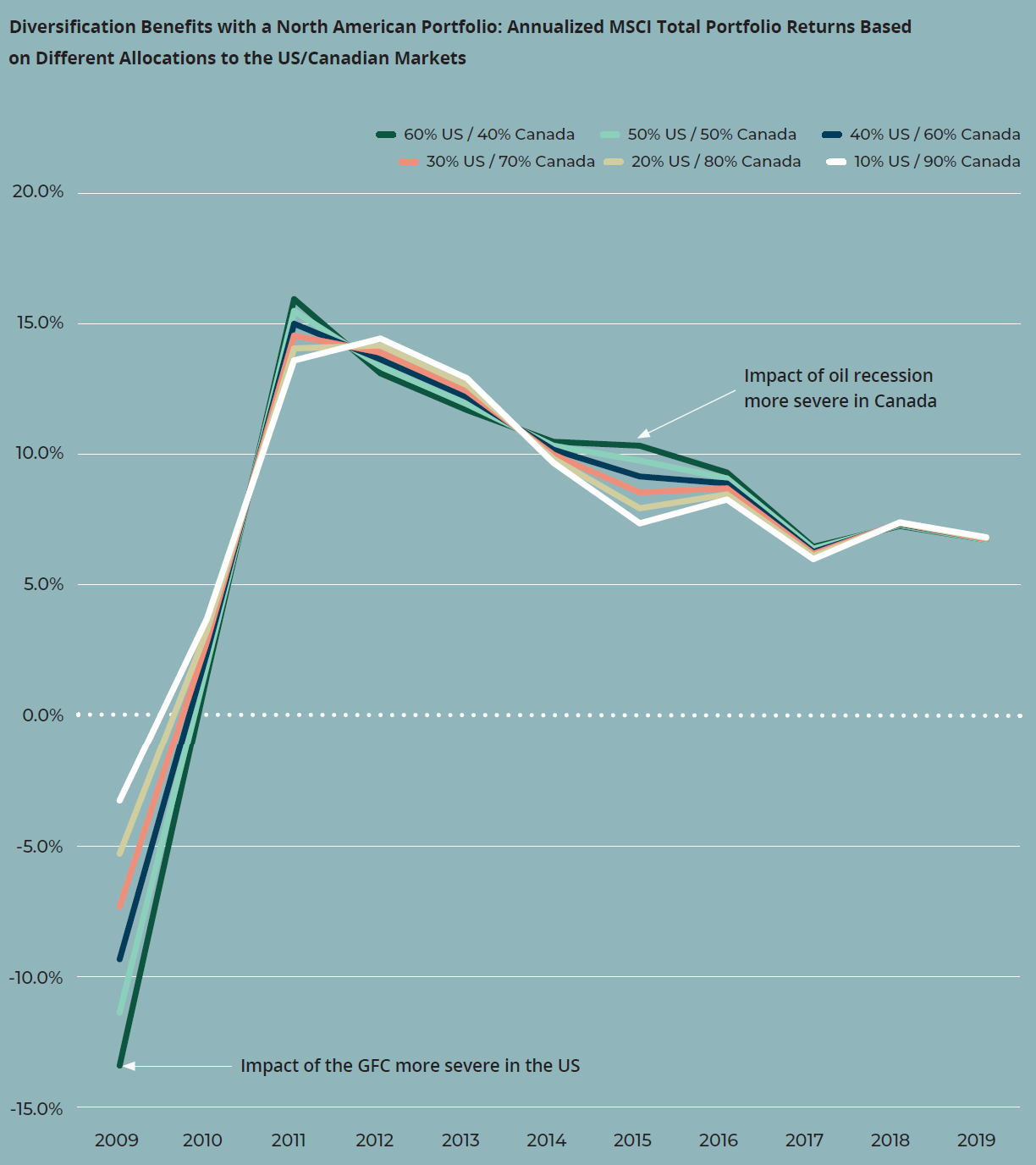

Cross-Border Diversification: Real estate has performed well in both Canada and the US, offering investors 9% average annual returns over the last decade according to the MSCI Direct Property Index. While total returns between the two markets have moved together historically, that pattern has eroded in recent years. Divergence in economic performance, capital appreciation and income growth are apparent, particularly when examining performance at the city and asset class level. All support the merits of diversification and cross-border investment.

Reducing domestic concentration risk: One compelling benefit of investing the US market is reducing domestic concentration risk in Canada. Because of Canada’s relatively small size and population, most of the investible real estate nationally is within six markets—Toronto, Montreal, Vancouver, Calgary, Edmonton and Ottawa. Canadian property investors accordingly, tend to have sizable exposures to a limited number of markets and economies.

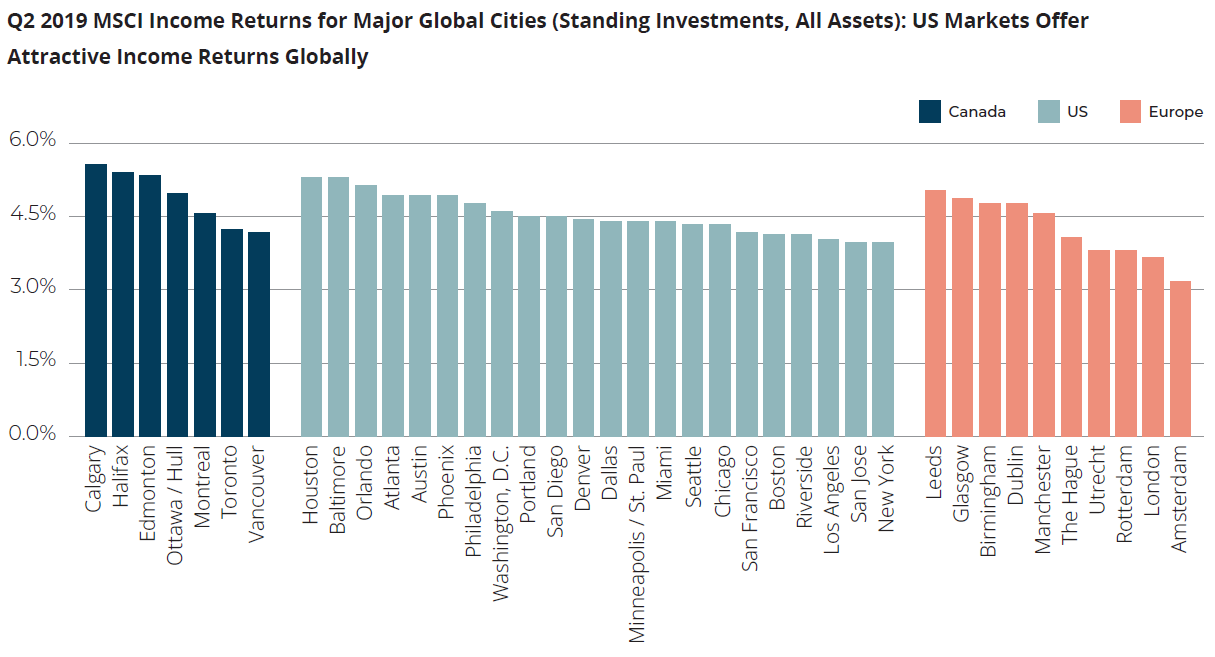

Stable income with capital growth potential: Institutional investors focusing on long-term income and asset value growth will continue to find the US market attractive. Capitalization rates (income returns) for US property remain attractive on a global basis with the potential for further income growth. Supply/demand also remains balanced across most major markets with controlled construction levels relative to pre-Global Financial Crisis levels.

For Canadian investors, there is no ‘one-size fits all’ approach to the US property market; size, liquidity, existing real estate portfolio and risk appetite should determine the investment strategy. Within private real estate, direct investments, open-ended property funds and close-ended property funds provide investors a range of options across the risk/return spectrum. Investment vehicle, tax, currency and regulatory requirements are also critical cross-border considerations for Canadian investors.

Based in Vancouver, Anthio brings more than 15 years of experience to GWLRA’s Research and Strategy team specializing in property market analysis, applied research and portfolio strategy. He has a Master’s in Urban Planning and Development from the University of Toronto.