Cap Rates, Interest Rates and Bond Yields: Looking Forward

With real estate capitalization (cap) rates at or near historic lows, investors continue to wonder how rising interest rates will impact property values and overall investment performance. The Bank of Canada’s decision to leave the key interest rate at 0.5% last Wednesday however—unchanged since July 2015—will give real estate investors more time to ponder this common but important question.

Real estate investors generally fear that rising interest rates will put upward pressure on cap rates, causing property values to fall. Rising interest rates can signal upward yield pressure on income-oriented investments such as real estate and bonds, weakening their relative market pricing. With cap rates, interest rates and bond yields as low as they are, the probability that they will eventually trend upward increases as time goes on—especially if the Canadian economy stays healthy.

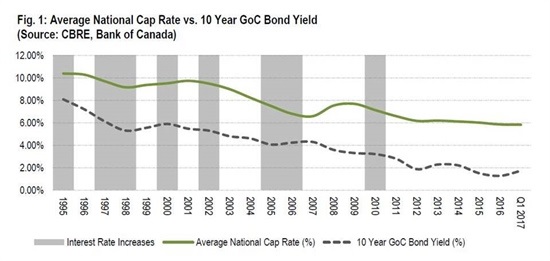

Figure 1, which shows cap rates (the National all property average), bond yields and notable periods of interest rate increases in Canada since 1995, suggests that rising interest rates do not always lead into higher cap rates. Time periods where rising interest rates preceded rising cap rates—notably 1998, 2000 and 2006—were also when major global economic shocks occurred or soon followed.

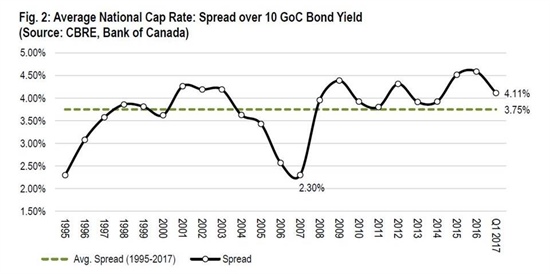

More important than interest rates however, is the direction of long term bond yields. There is usually a notable spread between cap rates and bond yields, reflective of the risk-premium associated with investing in real estate versus government bonds. The ten-year Government of Canada bond yield accordingly is commonly used to provide investors with pricing guidance for other asset classes, including real estate. Figure 2 highlights that the current spread between the national cap rate and the ten-year bond yield is 4.11%, slightly higher than the long term average of 3.75%. Cap rates and bond yields have seen a secular decline the last two decades with the 10-year bond yield dropping below 2% for the first time at the beginning of 2012. Despite bond yields trending upwards the last several months, current spreads remain at historical averages, and much higher than the 2.30% seen prior to the Financial Crisis. This current spread suggests some insulation if bond yields continue to trend moderately upwards. We also note that after moving to the 6% mark in 2012, cap rates have compressed at a much more moderate pace (looking back at Figure 1).

The data above suggests that interest rate increases do not always precede cap rate increases, nor should investors focus on interest rate movements in isolation. There are a wider number of variables impacting real estate values such as capital flows to real estate, the cost of debt, the larger economy and underlying supply-demand fundamentals. Steadily rising interest rates may signal a growing economy, for instance. Also important is the fact that real estate investment is increasingly global and movements in domestic interest rates and bond yields may not impact foreign investors with different motivations (and risk tolerances) for direct property investment. Individual property and market performance is also important, as properties that are able to drive significant rental growth tend to be more protected from cap rate shifts. As for risks if cap rates do move upward, a key concern is if cap rates rise at a faster pace than net operating income (NOI) growth can support. A higher cap rate relative to lower NOI signals declining property values.

Looking forward, investors should continue taking a long-term view on real estate, focusing on its ability to provide steady cash-flows throughout different economic and capital market cycles. Investors must also consider a wider range of factors outside of interest rates alone when considering the direction of property values.

Based in Vancouver, Anthio brings more than 15 years of experience to GWLRA’s Research and Strategy team specializing in property market analysis, applied research and portfolio strategy. He has a Master’s in Urban Planning and Development from the University of Toronto.