Eroding Dream of Home Ownership for Toronto’s Renters

For Toronto renters, the ability to own their home in the GTA region continues to decline. In 2010, nearly half could have afforded to purchase the lowest priced 10% of condominiums sold in the Toronto CMA region. By the end of 2016, only 39% could have become owners if desired.

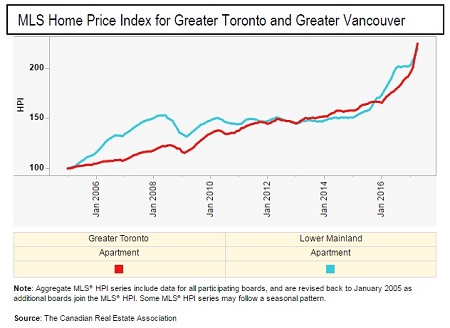

Given the sharp rise in the average home price in the GTA, eroding affordability for renters is not surprising. However, when compared with Vancouver, which has had a similar increase in home sale prices, it does stand out that Toronto has seen eroding affordability at this bottom 10% of the market while in Vancouver it has remained the same.

In five cities across Canada, GWL Realty Advisors tracks the ability of renters to become owners. This affordability measure is one of several tools used to monitor shifts in rental demand for the apartments we manage on behalf of investor clients. To create it, with the help of consultants GWLRA Research has

(1) Calculated the average sale price of the lowest 10% of homes sold in a metro area

(2) Used the average household incomes of renters in the metro area

(3) Assumed a 10% down payment and a 25 year mortgage at the posted rate

(4) Assumed a 27% Gross Debt Service Ratio (lower than typical as we do not otherwise account for condominium fees)

| Percent of renters who could afford ownership | 2010 | 2015 | 2016 | Income Required 2016 |

| Toronto | 48% | 42% | 39% | $52,092 |

| Vancouver | 38% | 47% | 47% | $46,015 |

This GWLRA approach to measuring affordability provides a more accurate perspective on first time buyers’ purchasing power than other measures such as those comparing overall average incomes and overall average home prices across a region.

Looking ahead, if the availability of lower priced condominium homes does not increase, GWLRA anticipates further increases in demand for rental housing in the Toronto area as the normal flow of some renters into ownership will be delayed.

Leading the national Research and Strategy team, Wendy’s responsibilities include providing economic, demographic and market-trends analysis to support long-term asset acquisition, development and management strategies. Wendy has been working in real estate research since 2002, including over a decade with GWL Realty Advisors. She holds a Ph.D. in comparative-world and economic history from the University of Arizona.