Major Metros Attracting Majority of Canada’s Employment Growth.

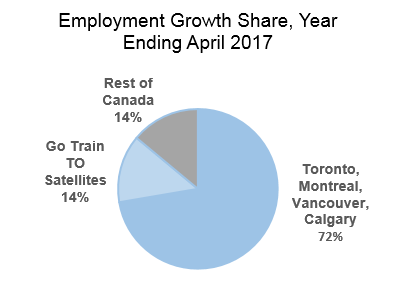

Canada’s larger cities have generated a disproportionate amount of national employment growth over the past year. The four metro areas of Toronto, Montreal, Vancouver and Calgary accounted for 72% of national job expansion. If the surrounding areas of Toronto are included (“Go-Train Toronto”), 86% of employment growth happened in the largest metropolitan regions. Indeed Toronto and its Go-Train satellite cities combined for 40% of national net employment growth.

Real Estate Implications

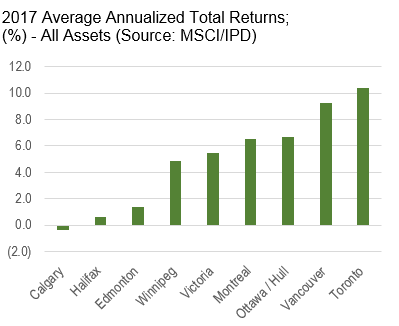

Strong employment growth has driven the office and industrial vacancy rates in Toronto and Vancouver to levels at or near the lowest in North America and all-time lows. Similarly, total returns in these markets have led the country supported by strong investment demand and rental growth. Although Calgary’s employment rebound has not resulted in a downtown office resurgence, it has likely contributed to a stabilization in occupancy rates in the node.

Employment growth in all cities, including Calgary, has supported demand for other real estate asset classes. Job expansion has contributed to strong retail sales growth, which benefits both shopping centre tenants and the industrial markets.

And rental apartment demand has expanded in all of these markets. In Toronto and Vancouver, employment and related in-migration has generated acute demand for housing, both rental and ownership. As new supply has not kept pace with demand, both rents and sale prices have risen—when someone can even find a home to rent or buy–creating new challenges for employers to continue hiring. Montreal is experiencing a more moderate version of the same phenomenon. And in Calgary a wave of new-generation purpose-built rental supply has quickly been absorbed.

Challenges ahead?

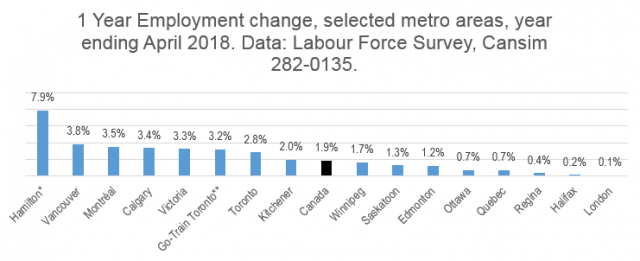

Strong job growth is generating challenges for some metro area economies. Both Toronto and especially Vancouver are experiencing labour shortages in certain sectors. Construction, transportation, retail sales and health care are sectors where the numbers suggest particular challenges. Labour shortages generally drive up business and wage costs, which impact construction costs for real estate as well as operational costs for all businesses, especially retailers. A lack of retail staff may also impact retailers’ decisions to expand or remain open in certain retail centres. Insufficient truck drivers across North America may change logistics strategies including real estate location decisions. At GWLRA, we will continue to monitor how these challenges impact the local economies and real estate markets, nationally.

The Labour Force Survey is based on where people live, not where they work. We believe that a significant proportion of the Hamilton employment growth is people with jobs in the Toronto CMA (whether downtown or in a suburb like Oakville) who have chosen to live in Hamilton

“Go Train Toronto” refers to the CMA of Toronto and the Satellite cities connected to Toronto via Go-Transit. This is modestly different from the Greater Golden Horseshoe which also includes communities not connected via Go-Transit.

Leading the national Research and Strategy team, Wendy’s responsibilities include providing economic, demographic and market-trends analysis to support long-term asset acquisition, development and management strategies. Wendy has been working in real estate research since 2002, including over a decade with GWL Realty Advisors. She holds a Ph.D. in comparative-world and economic history from the University of Arizona.