Mental Health and the Path to Office Demand Certainty in Canada: Part I of a Series on the Post-COVID Office

Office tenants currently struggle to understand how and where their employees will want to work post pandemic. Presently, many office workers express concern about returning to the office--even once the pandemic subsides. Some fear the transit commute while others are wary of being around myriad people again. The pandemic has resulted in mental health (or “brain health”) challenges. Healing needs to happen before more certainty will emerge for tenants on office space requirements. GWLRA Research has been monitoring non-real-estate signs of this psychological recovery, which will provide us with indicators that a broader return to office is pending.

Office workers’ stated preferences for post-COVID work patterns can be challenging to interpret. Some simultaneously report an inferior working experience from home while also wanting to continue remote work, for example.1 Many people responding to polls are under stress from COVID-19 or the impacts of the isolating restrictions, making it challenging for employers to understand and plan their post-COVID office space needs.

A large challenge facing employers and those trying to anticipate future office demand is whether individuals currently expressing a preference for more remote work will change their minds once it feels safe to go to the office and if most of their colleagues or their leaders are back in person.

GWLRA Research monitored the process of returning to the office in different global cities in 2021 to try to understand how pandemic attitudes about returning to the office can shift as normalcy returns. We have also been analyzing more broadly office employee motivations for their expressed workplace preferences. Additionally, from conversations with counterparts globally, we noticed that some individuals, as well as the collective cities, seemed to have less stress about COVID and as a result, had higher rates of returning to the office in the fall of 2021. This led us to investigate whether in Canada current anxiety levels around COVID as well as habits developed since March 2020 may be impacting many office workers’ answers about a future return to the office.

Ending government-imposed restrictions may not be enough to bring people willingly back to the office.

Brain Health and Return to Office

Psychologists and historians have noted that the mental health impacts of pandemics, and similarly restrictive events such as wars or attacks, outlast the physical impacts by months and even years.2 COVID has been a slow-moving yet traumatic event for many. A Harvard Medical School study found that in people who did not contract COVID, the lockdowns themselves contributed to (or caused) neuroinflammation leading to depression, anxiety, brain fog, fatigue and PTSD- type symptoms (Post-Traumatic-Stress Disorder).3

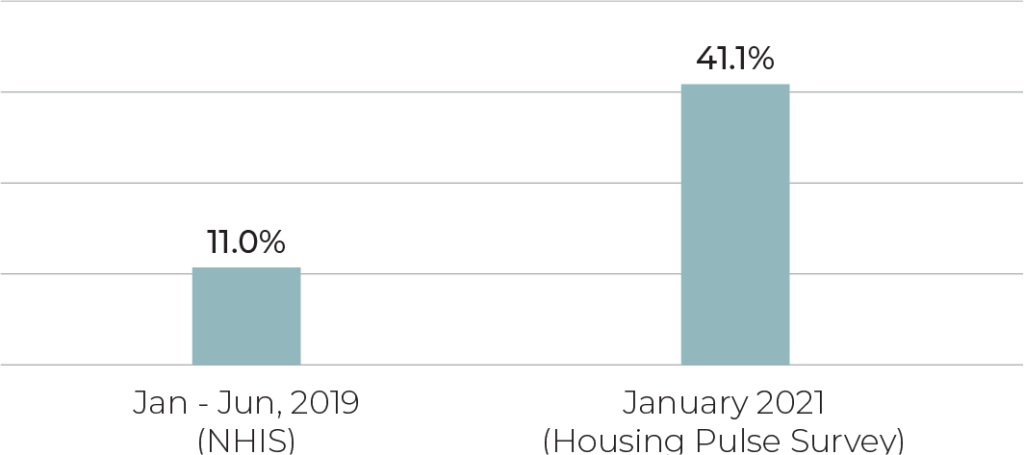

The general environment of uncertainty around the virus alongside government- and self-imposed restrictions has resulted in brain health disorders that need to heal. As broader evidence, in one study six times as many Americans (or 41.5%) reported mental health issues in 2020 as in 2019.4 In another survey reported in the Wall Street Journal, over 62% of workers thought their employers needed to offer more mental health supports–a significant increase over 40% pre COVID, suggesting more workers need help or know someone who does.5

Although likely not identical, we can assume Canadians—with generally more government-imposed restrictions—experienced similar or worse brain health stresses.

Figure 1. Average shares of adults reporting symptoms of anxiety disorders and or depressive disorders, January–June 2019 vs. January 2021

Notes percentages are based on responses to the GAD-2 and PHQ-2 scales. Plus figures (Shown here from January 6–18, 2021) have been stable overall since data collection began in April 2020.

Notes percentages are based on responses to the GAD-2 and PHQ-2 scales. Plus figures (Shown here from January 6–18, 2021) have been stable overall since data collection began in April 2020.

Source: NHIS Early Release Program and US Census Bureau Housing Pulse Survey.

There is some Canadian information involving adults and their personal anxiety or mental or health levels. Mental Health Research Canada has done 10 polls asking people about their anxiety and depression before and during the COVID-era. Those reporting low anxiety has fallen from 54% to 35% while those experiencing high anxiety has risen from 9% to 24% as of December 2021 (and actually peaked at 27% in May 2021 before declining in the summer when cases were lower and edging back up when the Delta and Omicron variants appeared).6

Further information from polling companies Abacus Data and Leger 360 confirms high levels of COVID fears in Canada. Abacus has reported that despite most Canadians being vaccinated, over half of Canadians were somewhat to extremely worried about the COVID situation in December 2021. Additionally, the vaccinated are far more worried about COVID than the unvaccinated.

While it is possible some poll respondents are thinking about society, or hospitals and health care workers, rather than themselves, this continued fear among the vaccinated will limit interest in returning to more normal living patterns.7 Leger360 also polled Canadians on their concerns about COVID-19, noting that 56% at the January 2022 poll were afraid of personally contracting it, up only slightly from pre-Omicron. And the fully vaccinated were more likely than the non-vaccinated to express this fear (60% vs 14%).8 This is despite considerable scientific evidence that the virus now poses limited risk to fully vaccinated healthy people beyond having an illness that resembles a cold or flu.9

As we approach two years living with ongoing as well as fluctuating restrictions, combined with new worries from novel variants and impacts from new limitations, it is likely that brain health challenges continue to impact office workers at home as well as their outlook on returning to the office. If over half of Canadian office workers are experiencing moderate or more severe anxiety, depression, agoraphobia, or various manifestations of PTSD, it is difficult to rely on an office worker’s survey response about how they might wish to work in the future. They need the opportunity to heal first, which fortunately, we can and will be measuring indirectly.

Recovering from pandemic brain health issues will take time. Healing any injury, whether to a limb (such as a heavy sprain) or the brain (such as a concussion) happens at a different pace for each person. The process of healing recommended by experts typically involves rest initially, followed by gradually pushing the injured limb or the brain to a point of mild discomfort, and then retreating, resting, and repeating. Although setbacks occur, usually the injured person can push further each day or every few days. Over days or weeks or months, depending on the individual and severity of the injury, a person gradually returns to normal activities.

Based on this experience or analogy, we are assuming that before many individuals will feel comfortable returning to the office, they will need to take other smaller steps toward normalcy in their daily lives to help heal their brains. Meeting friends for lunch or dinner, shopping at a mall as well as attending a sport, theatre or concert event are examples to look for of comfort indicators—that is, useful signals as to where a population is on the spectrum of “extreme COVID anxiety” to “accepted coexistence” with the virus (GWLRA Research has not seen any compelling scientific evidence that this virus will ever disappear).

Toronto Sick Kids’ Hospital did a survey that found 70% of adolescents “reported clinically significant depressive symptoms during the second wave.” This coincided with the 2020-21 school year, during which most Ontario adolescents only online school; spending all day isolated and trying to learn over Zoom or Teams (or old school worksheets) likely contributed to the mental health challenges. Extrapolating to adults, working remotely in isolation likely had negative mental health impacts. Moreover, parents of children struggling with mental health will themselves be dealing with extra stress, impacting their own brain health. These adults cannot likely provide accurate answers as to how much remote work they would prefer in six to 24 months.

Small Steps Toward Return.

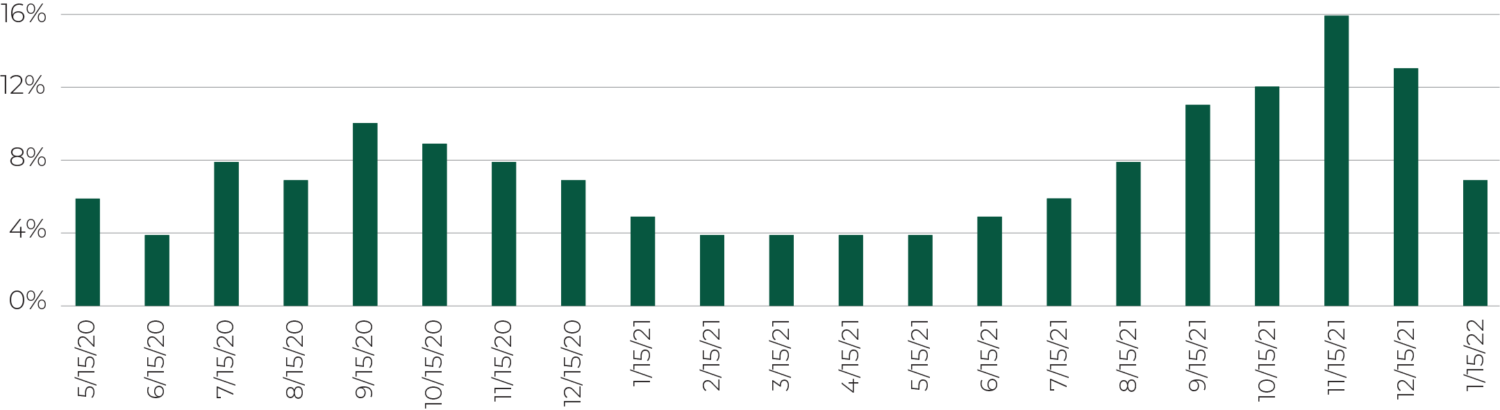

Prior to Omicron, society was demonstrating growing comfort with returning to pre-pandemic activities, coupled with a gradual return to the office. Office occupancy levels in Toronto had reached 16% after months in the 5% range according to SRRA.

In the Avison Young Vitality Index, Toronto downtown foot traffic prior to omicron was up to 25% of pre-COVID levels, after being as low as 7% of pre-pandemic activity. In Montreal daily activity had reached 25% of early 2020 levels, up from 11% of normal in March 2021.

Figure 2. Downtown Toronto Occupancy Index (Compared to January 2020). Data: SRRA

Index calculated as a percentage pre-Covid occupancy.

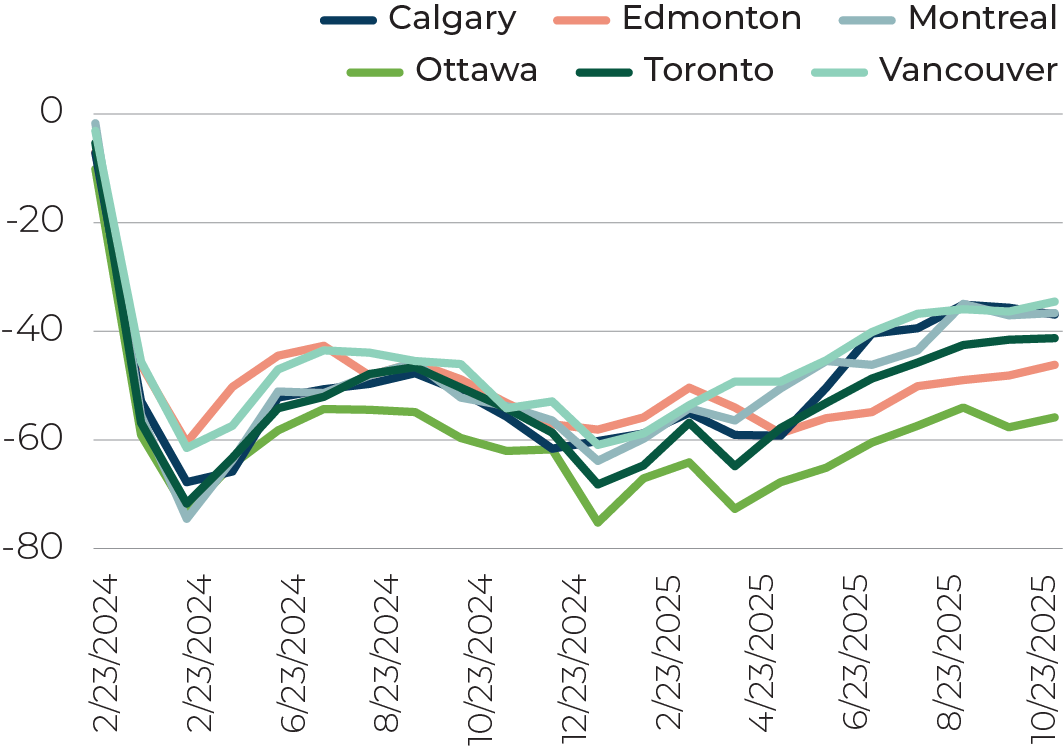

Transit ridership is a good indicator of pandemic recovery. Google’s mobility data for transit station visits suggests that Montreal, Calgary and Vancouver metro areas had recovered over half of their lost ridership when the Christmas break and Omicron variant arrived in late 2021.

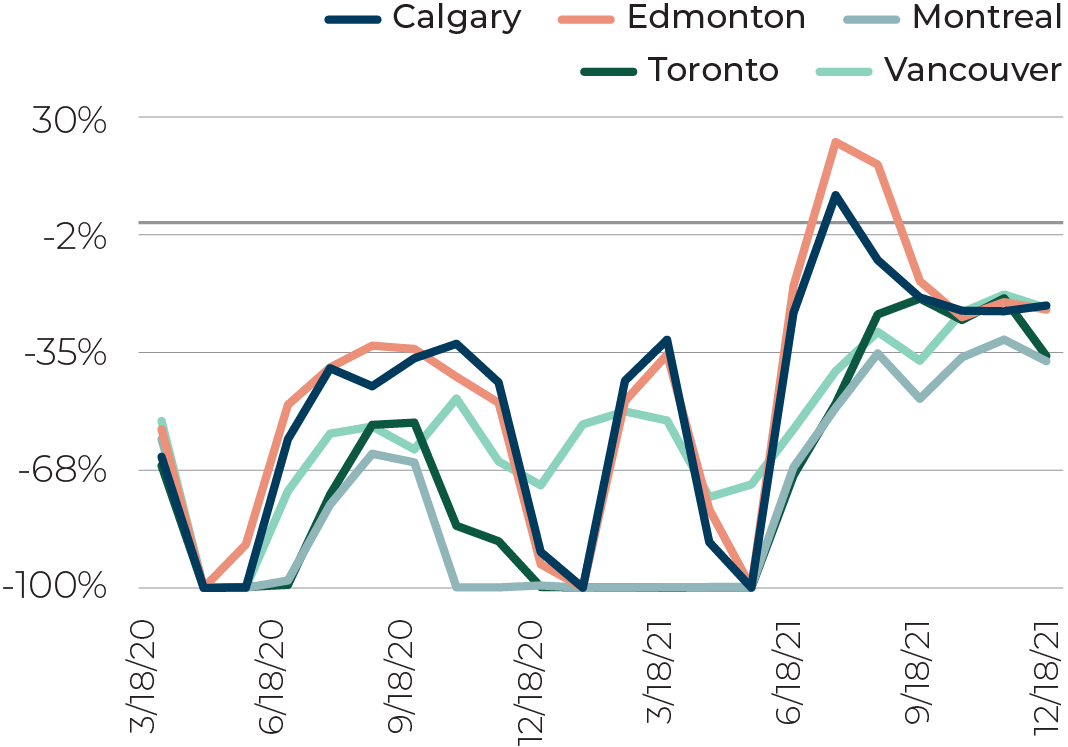

Figure 3 - Transit Station Visits. 7 Day Rolling Average Decline (in percent).

Source: Google Mobility Data. Based on location data from smartphones from people who have opted in to storing their location history with Google

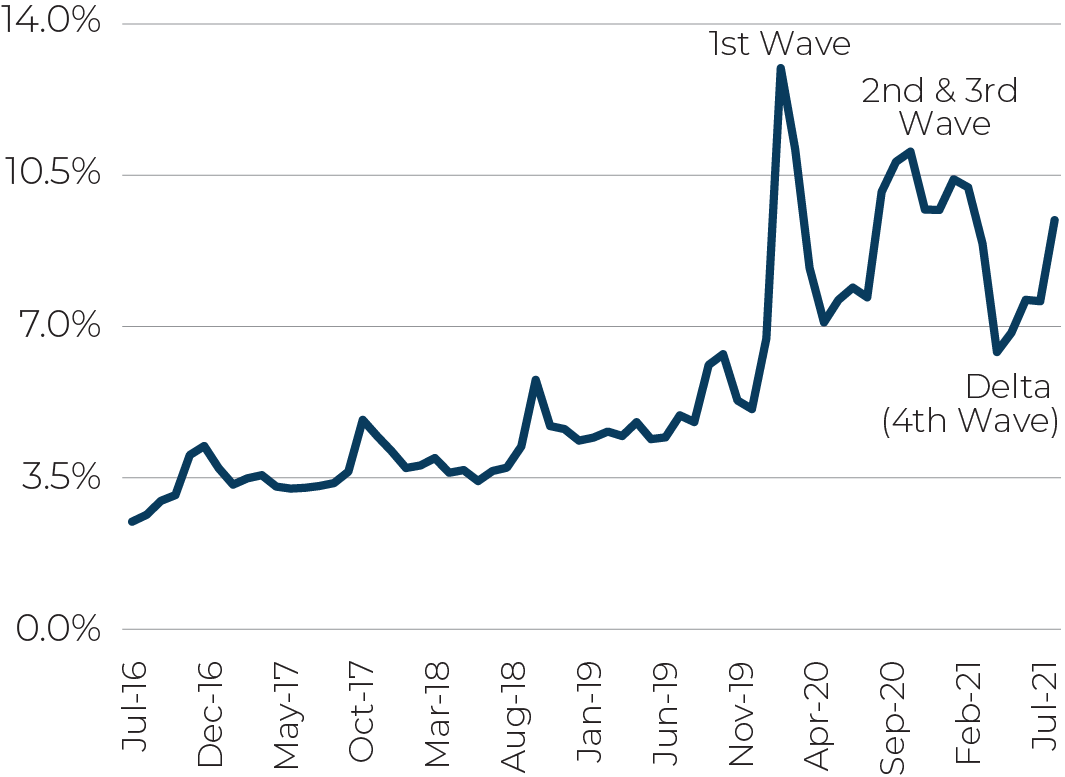

Meanwhile restaurant seating shows other helpful patterns for understanding recovery. In the summer, once most Canadians had the option to be fully vaccinated and COVID case counts were lower, restaurant dining peaked at above pre-COVID levels in Calgary and Edmonton according to Open Table, which tracks both reservations and seating for usually medium-to-larger restaurants, often in the downtowns. Meanwhile in Toronto and Vancouver it had reached a level only 20% below normal.

Figure 4 - Open Table. Walk-In + Reservations.

% Change from Same Day in 2019. 7 Day Average

Seated Diners From Online, Phone and Walk-In Reservations. % Change from Same Day in 2019. 7 Day Average

Note: Both data for 2021 and 2020 use 2019 as a baseline.

Shopping patterns also provide an indicator of comfort. Prior to Omicron, eCommerce usage as a percentage of sales was trending downwards in Canada compared to earlier in the pandemic.

Another important factor will be COVID spending less time dominating the news headlines. Since March 2020, the daily case counts and hospitalization counts have often been the lead story. This exacerbates fear; myriad numbers are often broadcast, frequently without appropriate interpretation. For example, are people with mild cases examples of vaccines failing or vaccines working? For those thinking the former, the COVID risk will feel higher.

Before we see a substantial return to the office, COVID will need to feel less threatening to Canadian office workers, and each will get there at their own pace. GWLRA Research will be tracking these indicators and others to better understand the collective recovery in Canada’s metro areas.

In parts II and III of this series, we look at different options being given to workers during this transition time, how employee choices are evolving and employer perspectives on balancing remote and at-office work are shifting, and what this could mean for future office demand.

Figure 5 - Canada Retail E-commerce Sales as % of all Retail (Ex Auto). Unadjusted

Source: Statistics Canada (To Nov 2021-Pre-Omicron)

1 See GWLRA Research, The Role of Office Space in Supporting Diversity, Equity and Inclusion: Working from Home has Unintended Consequences. 9 August 2021. Access at www.gwlra.com/research

2 Nirmita Panchal, Rabah Kamal, Cynthia Cox, and Rachel Garfield, “The Implications of COVID-19 for Mental Health and Substance Use,” KFF, 10 February 2021. Accessed 7 January 2022: https://www.kff.org/coronavirus-COVID-19/issue-brief/the-implications-of-COVID-19-for-mental-health-and-substance-use/; Maddy Savage, “Coronavirus: The possible long-term mental health impacts,” BBC 28 October 2020. https://www.bbc.com/worklife/article/20201021-coronavirus-the-possible-long-term-mental-health-impacts Accessed 7 January 2022.

3 Jocelyn Solis-Moreira, “Research finds increases in ‘pandemic brain’ after COVID-19 lockdowns,” News-Medical.net, 29 Sept 2021. Accessed 17 December 2021. Brusaferri L, et al. (2021). The Pandemic Brain: neuroinflammation in healthy, non-infected individuals during the COVID-19 pandemic. medRxiv. 27 September 2021.

4 Sharon Guynup, “Why ‘getting back to normal’ may actually feel terrifying,” National Geographic 20 May 2021.

5 Te-Ping Chen and Ray A. Smith, “American Workers are Burned Out, and Bosses are Struggling to Respond,” WSJ 21 December 2021.

6 Mental Health Research Canada, Mental Health During COVID-19 Outbreak: Poll #10, 22 January 2022. Accessed at https://www.mhrc.ca/national-polling-COVID 25 January 2022

7 Abacus Data, “Fear of Omicron triggers anxiety across Canada,” 30 November 2021. Accessed abacusdata.ca/COVID-anxiety-worry-omicron/ 25 January 2022.

8 Leger 360, North American Tracker, January 10th, 2022 edition, accessed https://leger360.com/surveys/legers-north-american-tracker-january-11-2022/ 25 January 2022.

9 Province of British Columbia, “COVID-19: Hospitalization Risk. Preliminary Analysis of Cases Dec 14-Jan 6”, 21 January 2022.

Leading the national Research and Strategy team, Wendy’s responsibilities include providing economic, demographic and market-trends analysis to support long-term asset acquisition, development and management strategies. Wendy has been working in real estate research since 2002, including over a decade with GWL Realty Advisors. She holds a Ph.D. in comparative-world and economic history from the University of Arizona.