Office Demand in the New Economy: Looking Beyond COVID-19

Despite near term disruption with COVID-19, the emergence of new industry sectors and related employment growth will continue to drive office demand long-term.

In 2016, GWL Realty Advisors completed a study on the Canadian Financial Services sector exploring the shifting nature of office work in that industry. A key finding was that while automation and digitization was reducing demand for traditional banking roles, the industry was rapidly hiring in software, digital media and data science. Tighter banking regulations as a result of the 2008-2010 Global Financial Crisis further grew positions in risk management, insurance and compliance.

The net effect was significant labour growth within Financial Services despite expectations of broad industry consolidation. Canadian office markets, particularly downtown Toronto, Vancouver and Montreal, benefitted from this trend.

The 2016 report draws important parallels to today’s market environment with COVID-19.

In recent weeks, there has been a wave of corporate announcements suggesting sustained momentum for remote office work. Digital technology, shifting corporate cultures and forced quarantines from COVID-19 have many organizations embracing work arrangements outside the office for the immediate (and extended) future.

An immediate reaction by some is that this new work-from-home (WFH) environment poses a threat to office demand. From our perspective, while flexible work arrangements will make some organizations more efficient with their office occupancy requirements, overall labour growth—particularly in emerging industries such as technology and health—will support office demand going forward. This Research Note expands on this perspective.

Emerging Labour Sectors

According to the World Economic Forum’s Future of Jobs Report, 58 million new jobs will be created globally between 2018 and 2022, mainly in emerging industries such as artificial intelligence, health care, cloud computing, ‘green’ economy, software and content and information.1 Many of these roles did not exist the prior decade and are reflective of changes to consumer preferences and rising technological adoption.

The COVID-19 pandemic and associated quarantines are likely to accelerate growth in many of these sectors. Growth in ‘STEM’ (Science, Technology, Education and Media) roles are set to intensify further as consumption habits structurally change with COVID-19. Software, e-commerce, social networking and digital media companies continue hiring through this crisis due to elevated demand for streaming services, online shopping, social media and cloud technology. The exponential rise of Zoom2, Azure and Amazon Web Services for example, are reflective of this trend.3 Healthcare, life sciences, security and ESG (Environment, Sustainability and Governance) compliance are other sectors expected to see long-term growth from COVID-19 as pandemic risk-management and vaccine development grows in global importance.

Employment Numbers in Perspective

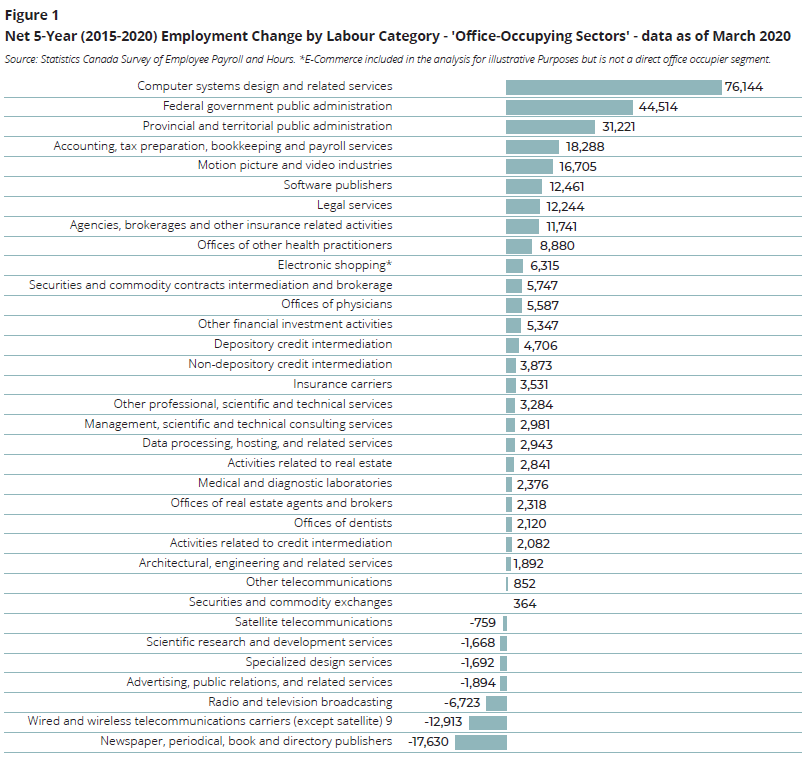

Labour themes in Canada highlight the role these emerging sectors have had on office demand. Focusing on ‘office-occupying’ industries from Statistics Canada (Figure 1), we can see significant employment growth has come software development (‘computer systems design’), digital entertainment, software distribution and e-commerce in recent years. Net labour growth in these sectors have more than offset losses in ‘traditional’ industries such as telecommunications, broadcasting and public relations that have been in structural decline the last decade.

Equally important in Figure 1 is that traditional office-occupying sectors in public administration, accounting, law, and finance have also seen significant growth in recent years, highlighting the important link between overall economic expansion, labour growth and office demand. Overall, 250,000 net new office-occupying positions were created the last five years according to Statistics Canada payroll data, opposite to 44,000 jobs lost due to structural factors. Applying a simple 75-150 square feet (SF) per person occupancy ratio suggests 18.6 million to 37.2 million SF of potential office demand was created in Canada over that time.

Overall, regardless of the specific work-from-home scenarios and square feet per person ratios employers may take going forward, labour growth will continue to drive office demand.

At GWLRA we continue to monitor office market trends and will publish perspectives on this topic going forward.

Related Research Notes

Poll Results: Many Canadian Office Workers Struggle with Productivity at Home

Office Space Plays a Key Role in Productivity

(Special thanks to Sara Obidi, a Masters of Urban Studies Candidate at Simon Fraser University for her research contributions).

[1] The World Economic Forum Reports notes 133 million jobs will be created in emerging labour sectors between 2018-2022, offsetting 75 million jobs that could be lost due to technological disruption. The net effect is 58 million net new jobs in mainly new sectors. Source: World Economic Forum, “5 things to know about the future of jobs”, 17 September 2020, accessed at: https://www.weforum.org/agenda/2018/09/future-of-jobs-2018-things-to-know/

[2] Rex Crum, “Coronavirus: Zoom Video to hire 500 new software engineers as usage surges”, The Mercury News, Accessed at: https://www.mercurynews.com/2020/05/14/coronavirus-zoom-video-to-hire-500-new-software-engineers-as-usage-surges/

[3] Aaron Tilley, "One Business Winner Amid Coronavirus Lockdowns: the Cloud”, The Wall Street Journal, 27 March 2020, accessed at: https://www.wsj.com/articles/one-business-winner-amid-coronavirus-lockdowns-the-cloud-11585327905

Based in Vancouver, Anthio brings more than 15 years of experience to GWLRA’s Research and Strategy team specializing in property market analysis, applied research and portfolio strategy. He has a Master’s in Urban Planning and Development from the University of Toronto.