The Pending Rental Demand Tsunami in Canada

Canada’s major cities currently face a rental shortage. Vacancy rates have long been low in many Canadian cities and below 1% in much of the Vancouver market, with Toronto not significantly higher. Meanwhile demand continues to grow as these cities generate jobs and attract migrants. The result has been rising rental rates, especially as home ownership costs have increased forcing many to stay renters longer.

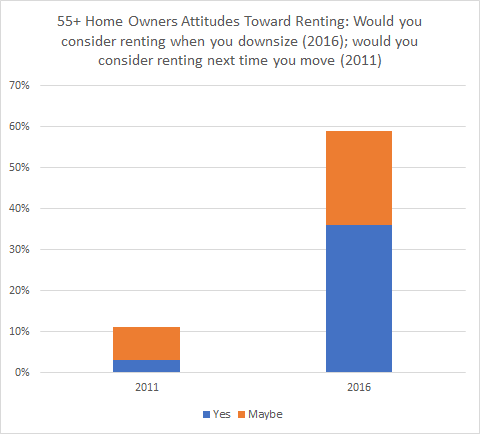

As we look ahead, demand for quality purpose-built rental could surge from the pending tsunami of downsizing retirees becoming attracted to rental offerings. According to a survey commissioned by GWL Realty Advisors (GWLRA), detached-house-owners over the age of 55, without children at home, have begun to embrace the concept of renting in the future. In a 2011 survey, less than 10% of house owners could envision even considering becoming renters. By 2016 that number reached nearly 60% among home owners considering downsizing in the future.

When shown photos of new, deluxe purpose-built rental with plank floors, stone counters, and the latest appliances, 82% of those considering rental said they would be more likely to rent if the suite looked like that.

Assuming the results are accurate, for the Toronto metro area, this would equate to approximately 80,000-100,000 additional households interested in renting when those currently 55 years old reach their downsizing decision and consider rental over the next 20 years. For Vancouver, 35,000-40,000 such additional potential rental households could materialize. Of course, not everyone will, in the end, select rental. This demographic and attitudinal shift nevertheless will likely still generate thousands of additional rental households.

This demand boost would be in addition to organic growth in the traditional renter demographics. In recent decades, households tended to rent in their younger years, or upon arrival in a new city, progressing to ownership and remaining owners for life even if they downsized to a condo. If returning to rental becomes part of the housing lifecycle for many Canadian baby boomers, unless the pace of constructing new rental increases, the supply of rental housing may not be sufficient to accommodate this new demand.

This is potentially good news for rental apartment investors, including the clients of GWLRA. Increased rental demand will support more rental developments. However, a larger proportion of retirees willing to become renters likely means modifications to the purpose-built rental offering and building design. Among other findings from the survey, this demographic was more likely to demand a 2 bedroom or larger unit, a private balcony, and superior service offerings as they look to trade ownership for hassle-free living.

Leading the national Research and Strategy team, Wendy’s responsibilities include providing economic, demographic and market-trends analysis to support long-term asset acquisition, development and management strategies. Wendy has been working in real estate research since 2002, including over a decade with GWL Realty Advisors. She holds a Ph.D. in comparative-world and economic history from the University of Arizona.