The Post COVID Office (Part II): Fear of Missing Out Versus Fear of COVID

Office workers—like everyone—have faced mental strains and brain health issues during the pandemic, as discussed in our previous Research Note. As a result, it is challenging to interpret their responses regarding workplace and remote work preferences post pandemic. And yet there are clues. Evidence exists that post-pandemic office work may not be as remote-based as some are assuming. In this report, we examine more granular information from before and during the pandemic that provides insights into likely outcomes once people feel safe again.

As discussed in Part I of this series, understanding future workplace needs is challenging when many office workers are stressed from months of restrictions and isolation. As a result, responses in surveys vary considerably. Generally, the majority seem to want a mix of office and remote work post pandemic; but exactly what that balance will be is unclear. Most employers (with some exceptions) continue to articulate and anticipate a gradual, flexible return to the office over 2022. This will give both employers and office workers an opportunity to explore new options and ways of working before setting more concrete policies and signing new office leases.

As the COVID pandemic drags on, office tenants around the world have struggled with decisions about the amount of office space they will need in the coming years. Most larger employers have announced allowing for some flexibility in terms of remote work at least some of the time post COVID, responding to expressed employee preferences. However, most also see the office as important to the future of the company as evidenced by significant new office leases as well as responses to surveys.

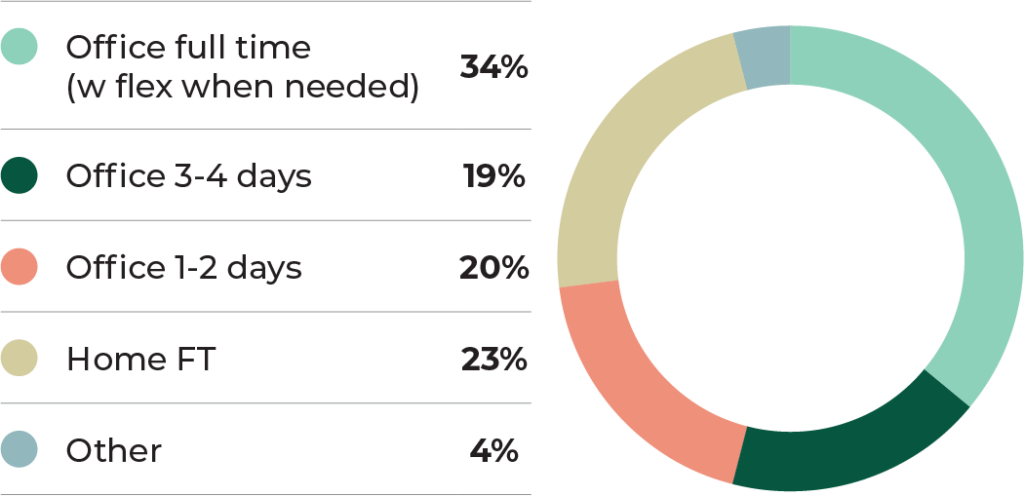

Figure 1. Post-COVID Workplace Preference. GWLRA Survey with Abacus Consulting. January 2021

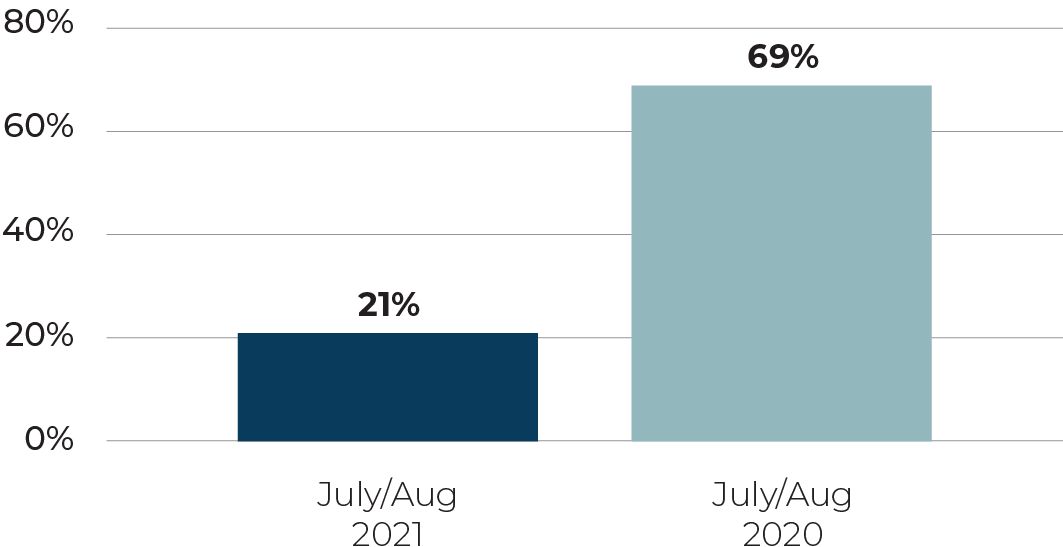

The leaders of most office-using companies have evolved their thinking during the pandemic, reaching a conclusion today that they will need all or most of their office space. A KPMG study of Fortune 500 office tenants found that while 69% of CEOs anticipated downsizing office space in August of 2020, by August 2021 that number had fallen to 21%.1 In a survey of 445 US firms for the Harvard Business Review, the authors calculated a combined total of a 1% reduction in office space.2

Figure 2. KPMG Fortune 500 Employer Office Downsizing Plans

While productivity was strong working from home in the first months of the pandemic, for most companies the gradual eroding of social capital (the connections between people that go beyond their place in a corporate hierarchy) has created challenges, including reduced enthusiasm, decreased quality or quantity of output, and increased resignations. For many companies, the conclusion is the office will be important to their future corporate culture and success.

The path back to the office in 2021

GWLRA Research has been monitoring return to the office in cities around the world, especially in the North America, during 2021. The return of leaders and senior and middle management was a key catalyst in the US where restrictions were lower, and office tenants could set their own policies. During Zoom or Teams meetings, employees still at home noticed that their colleagues or boss were in the office, and even together in a meeting room; this lead many to try returning themselves. Fear of Missing Out (FOMO) on contributing to an exciting deal or project, or on the social comradery from collaborating in person was an important factor in pulling people back to the office. Also essential in the above experiences, employees were allowed to come into the office if they wanted to do so. There were not restrictions on the number of people who could be there.

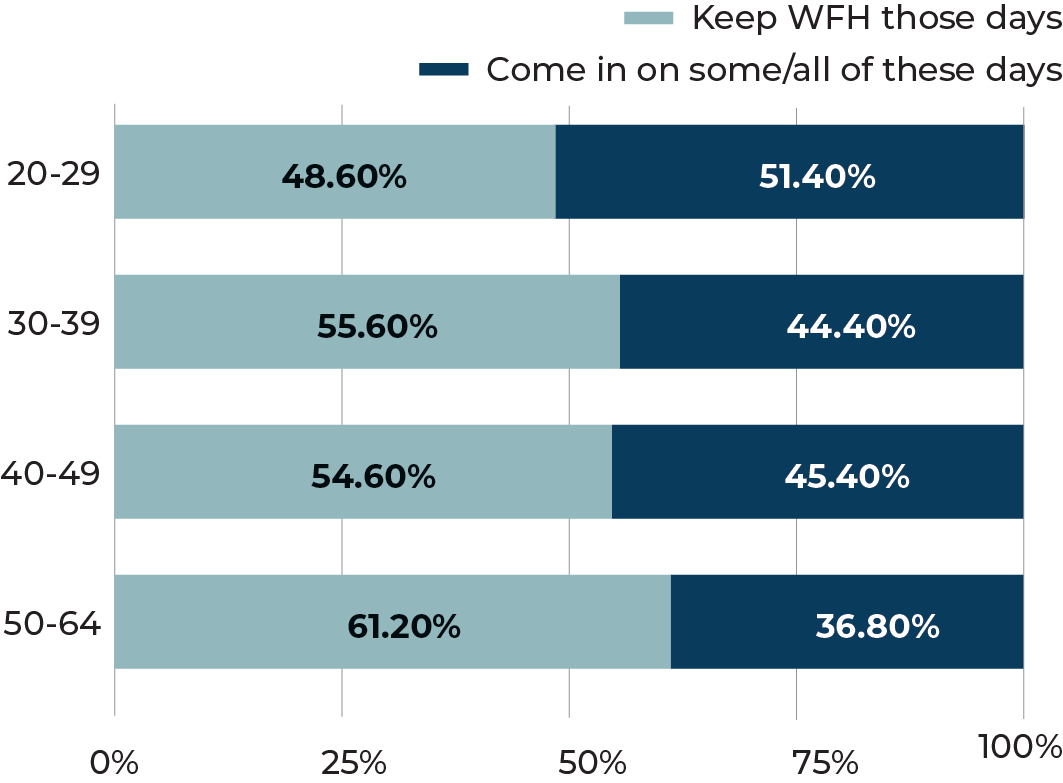

Surveys also suggest that whether for FOMO or obligation reasons, many will come into the office if their manager/leader does. A Stanford-affiliated “Work From Home” research project found that approximately half of employees expecting to work from home some days would go to the office instead if their leader did, with higher percentages in the younger age group and among women.3

In a GWLRA-commissioned survey with Abacus Consulting in January 2021, approximately 30% of those expressing a preference to work from home 3-4 days per week said they would want or need to be in the office more days if their leadership or team were also there. For immigrants and visible minorities (who also skew younger), this rose to over 50%.4

Figure 3. “Work from Home Research” on worker plans with manager at the office Survey: If your manager starts coming in on some of your work-from-home days, what will you do?

Source: Stanford “Work from Home” Research project

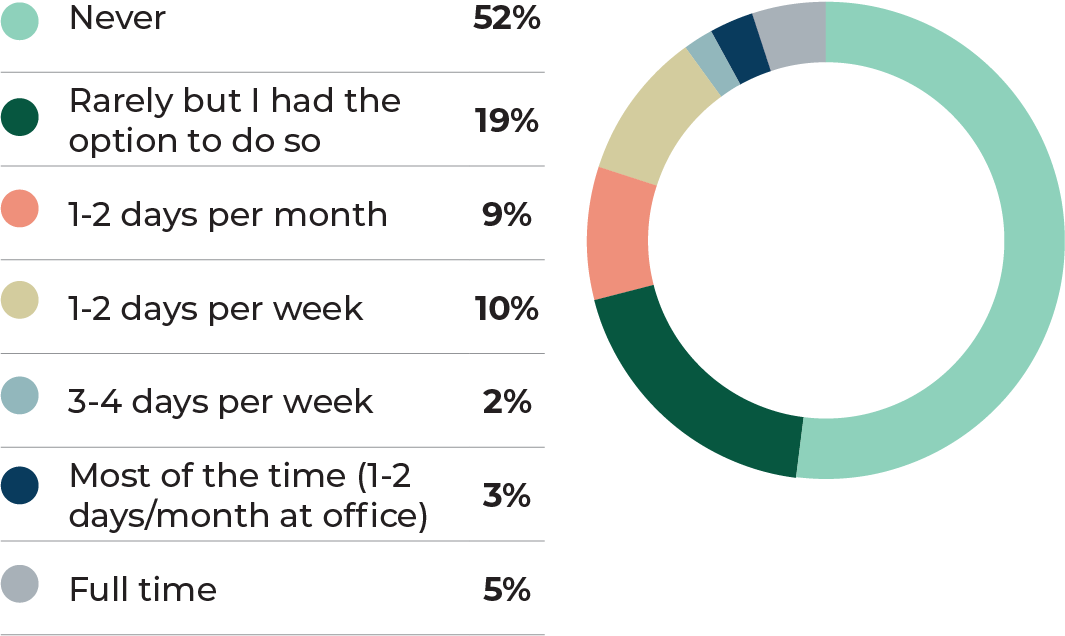

Figure 4. Pre-COVID Remote Work Before COVID-19, how often did you work from home?

Data: Abacus Data Survey for GWLRA January 2021

FOMO was likely a factor driving office attendance pre-COVID as well. According to a GWLRA survey with Abacus Data in January 2021, pre-COVID 48% or nearly half of downtown office workers had the option to work from home at least occasionally, and yet only 10% actually worked from home most of the time. Pre-COVID, giving people flexible options did not mean everyone chose to work remotely and therefore post-pandemic, we can also anticipate that once people feel safe, many will return to the office.

One key element drawing many back to the office will be the overall experience. Fear of missing out on important meetings for some will combine with an attractive overall office experience; this will be a powerful draw back to the office. There has been a long term trend of improving the overall workspace from the perspective of employee comfort, inspiration and productivity. Tenants have also gravitated toward locations that offer a wide range of amenities as well as frequent access to the broader industry for networking. Downtowns may soon be recognized for what they are, Richard Florida has argued, a Central Social District (“CSD”), instead or in addition to being a Central Business District (“CBD”). People will come downtown to see colleagues, and industry peers as well as to collaborate in formal and informal ways. And although productive work will be happening, it will have a social component to it—and for many will be a key reason to work downtown and from the office.

At a high-performing company, human connections are valued. When working together, in person, people share a joke, a laugh, a cry, or a frustration together. This is bonding. And it is part of the workplace experience that also helps with retention. These types of interactions do not typically happen over Zoom or Teams. Fear of Missing Out on these moments as well as on those teachable and professional development opportunities draw people to an office environment.

The need to build a culture that people fear missing out on will make office buildings and office space even more important post pandemic for many employers—but not all. Some will select a more remote approach. And even within the office-centric concept, there will be myriad experiments with the ideal layout and features which will impact office demand trends. We look at these options in depth in part III of this series.

1 KPMG, 2021 CEO Outlook: Plugged-in, people-first, purpose-led, 21 September 2021. Accessed 22 January 2022 at home.kpmg/CEOoutlook

2 Jose Maria Barrero, Nicholas Bloom and Steven J. Davis, “Why Companies Aren’t Cutting Back on Office Space,” Harvard Business Review 25 January 2022, accessed https://hbr.org/2022/01/why-companies-arent-cutting-back-on-office-space, 7 February 2022.

3 Jose Maria Barrero, Nicholas Bloom and Steven J. Davis, Survey of Working Arrangements and Attitudes (SWAA), January 2022 Updates, 19 January 2022. Accessed at:

https://wfhresearch.com 25 January 2022.

4 GWLRA Research, “The Role of Office Space in Supporting Diversity, Equity and Inclusion: Working From Home has Unintended Consequences.” August 2021. Downloadable at www.gwlra.com/research

Leading the national Research and Strategy team, Wendy’s responsibilities include providing economic, demographic and market-trends analysis to support long-term asset acquisition, development and management strategies. Wendy has been working in real estate research since 2002, including over a decade with GWL Realty Advisors. She holds a Ph.D. in comparative-world and economic history from the University of Arizona.