How GWLRA is Supporting a Better, More Sustainable World

One of the key themes to emerge from the UN Climate Change Conference of the Parties (‘COP26’) is the need for businesses to take more immediate and actionable measures to fight climate change. According to the Globe and Mail1 , the commercial real estate industry plays a critical role given that buildings and construction contribute nearly 40 per cent of energy-related greenhouse gas (‘GHG’) emissions globally. In Canada, our buildings require both heating and cooling and are particularly reliant on energy use, which in most cases produces GHG emissions.

Since 2013, we have reduced GHG emissions by 32 per cent and integrated sustainability into all our business units. From Portfolio Management and Research Services to Asset Management, Property Management, Development, Investment, and Corporate Office functions – sustainability considerations are critical to how we manage and grow our business.

“The challenge at the beginning was finding a way to more meaningfully weave sustainability across the business units,” says Robert Campanelli, Vice President, Corporate Sustainability. “Everything changed when we introduced our Building Sustainability Profile data management system. We moved beyond, disparate and disjointed quantitative and qualitative data to having access to timely, relevant, accurate, consistent and complete data, which gave way to highly actionable insights our teams now use to make key sustainability related decisions.”

One of the biggest barriers for businesses to embrace opportunities around Environmental, Social and Governance (ESG) issues is the perception that sustainability is costly. And while there may be considerable up-front capital investment required to complete, for example, a deep retrofit to an aging building, the long-term payoff can be significant.

In our case, we believe sustainability helps increase asset value and creates operational cost savings. It also helps to manage risks, future-proof our business against regulations, and improves our ability to attract and retain clients, tenants, residents, and employees. And finally, sustainability efforts enhance our brand and reputation while helping us reduce and better manage business risks.

“It’s something that’s not just supported from the top of the house, but rather embedded across the entire organization,” says Ben Lemire, Director, Corporate Sustainability. “While we’re improving performance and driving growth for our clients, we’re also cementing a strong reputation amongst our peers and the global real estate community as a company that takes ESG issues seriously and has the management systems and programming in place to address them.”

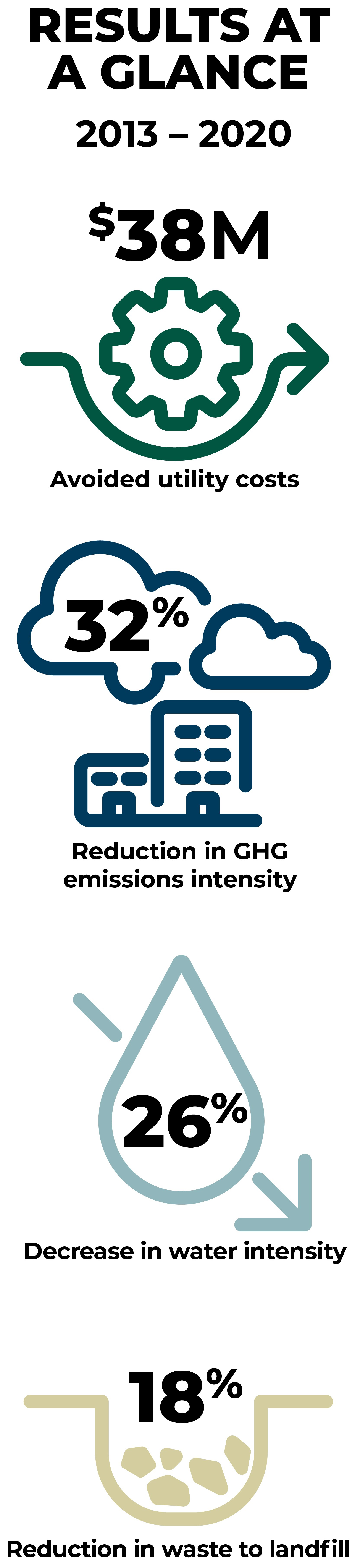

The results are impressive. Since 2013, across our portfolio, we have realized an estimated $38M in cumulative avoided utility costs. We’ve also reduced GHG emissions intensity by 32 per cent, decreased water intensity by 26 per cent and reduced waste to landfill by 18 per cent. Our efforts have earned us numerous industry awards, and in 2021 we were once again recognized as a leader by the Global Real Estate Sustainability Benchmark (GRESB), earning a Green ‘5’ Star rating for the seventh consecutive year. We also look to green building certifications, such as BOMA BEST® and LEED®, to provide third-party verification for building performance. In 2021, 92% of buildings in our eligible portfolio (by floor area) had at least one green building certification. “Results like these send a strong message to our investors and are a testament to our commitment to beneficially integrating environment, social, and governance considerations into the management of our assets,” says Steve Marino, EVP Portfolio Management.

We are also advancing our understanding of natural hazards and climate-related risks. The past year has shown the real impacts that natural disasters can have on people and places across Canada, which are only expected to increase in frequency and magnitude with climate change.

In 2021, we completed risk exposure assessments across all assets in the portfolio, covering 20 natural and climate-related physical hazards. The assessments included climate change projections for the years 2045 and 2070, under three warming scenarios, to better understand how the risk of climate-related hazards may evolve over time. We also incorporated a natural hazard and physical climate risk screening process during acquisition due diligence. The tool provides an additional lens to our existing processes for understanding what physical risks may be pronounced for new investments.

Overall, GWLRA’s Corporate Stainability practice is anchored by strong data management practices, strategic national programs, transparency through reporting and disclosure, and engagement with the industry. These pillars play an essential function in supporting our teams’ endeavours in working to advance GWLRA’s strategic business objectives and priorities.

While GWLRA is proud of its early progress and continues to contribute to the greater good by doing its part, we recognize that the Canadian real estate industry has only scratched the surface of what needs to happen if it is to achieve its environmental ambitions, especially those in line with global efforts to achieve net-zero GHG emissions by 2050.

“It’s a rewarding time to be in sustainability, trying to make this monumental push,” adds Krystian Imgrund, Director, Corporate Sustainability “It’s all hands-on-deck and involves collaborating across the aisle with our peers globally, where everyone is working together to get across the finish line. It’s a massive challenge, and we all need to do our part.”

At GWLRA we take our role in the fight against climate change seriously. Our parent organization, Great-West Lifeco, is committed to net-zero greenhouse gas emissions by 2050, for their operations and financed emissions (see link). We look forward to supporting their efforts through the assets we manage on their behalf and further building on our track record with our own announcement coming in the new year.

[1] Commercial real estate developers grapple to adapt climate-change measures" David Israelson Special to The Globe and Mail Published August 24 and updated on August 27, 2021.

GWL Realty Advisors Inc. generates value by creating vibrant, sustainable communities that engage, excite and inspire. As a leading Canadian real estate investment advisor, we offer asset management, property management, development and specialized advisory services to pension funds and institutional clients. Our diverse portfolio includes residential, industrial, retail and office properties as well as an active pipeline of new development projects.