Private Real Estate: Proving a Strong Hedge to Inflation

In a Research Note published at the start of this year, we concluded that private real estate has historically proven a strong hedge to rising inflation. Generally, when inflation is elevated, private real estate has provided both strong total returns and rising property cashflows—albeit with variation across asset cases.

Data through the balance of 2022 has demonstrated private real estate’s inflation hedging capabilities this cycle.

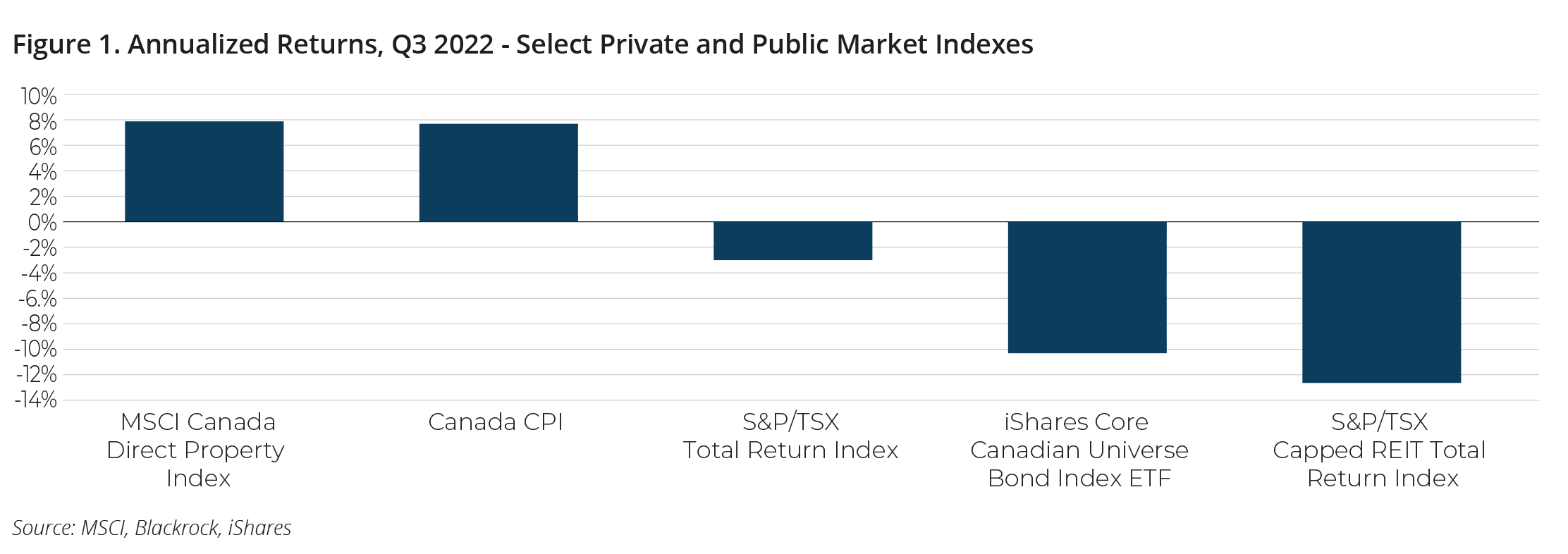

As of Q3 2022, private real estate has generated an annualized return of 7.5% according to the MSCI Canada Direct Property Index. After modest declines of -4.0% through the early phases of the Pandemic, returns for direct real estate have rebounded back to historical levels, averaging 8.2% the last 12 months. Relative to comparable public market assets such as Real Estate Investment Trusts (REITs) and Fixed Income, private real estate has been one of few market sectors to keep pace with inflation to date (Figure 1).

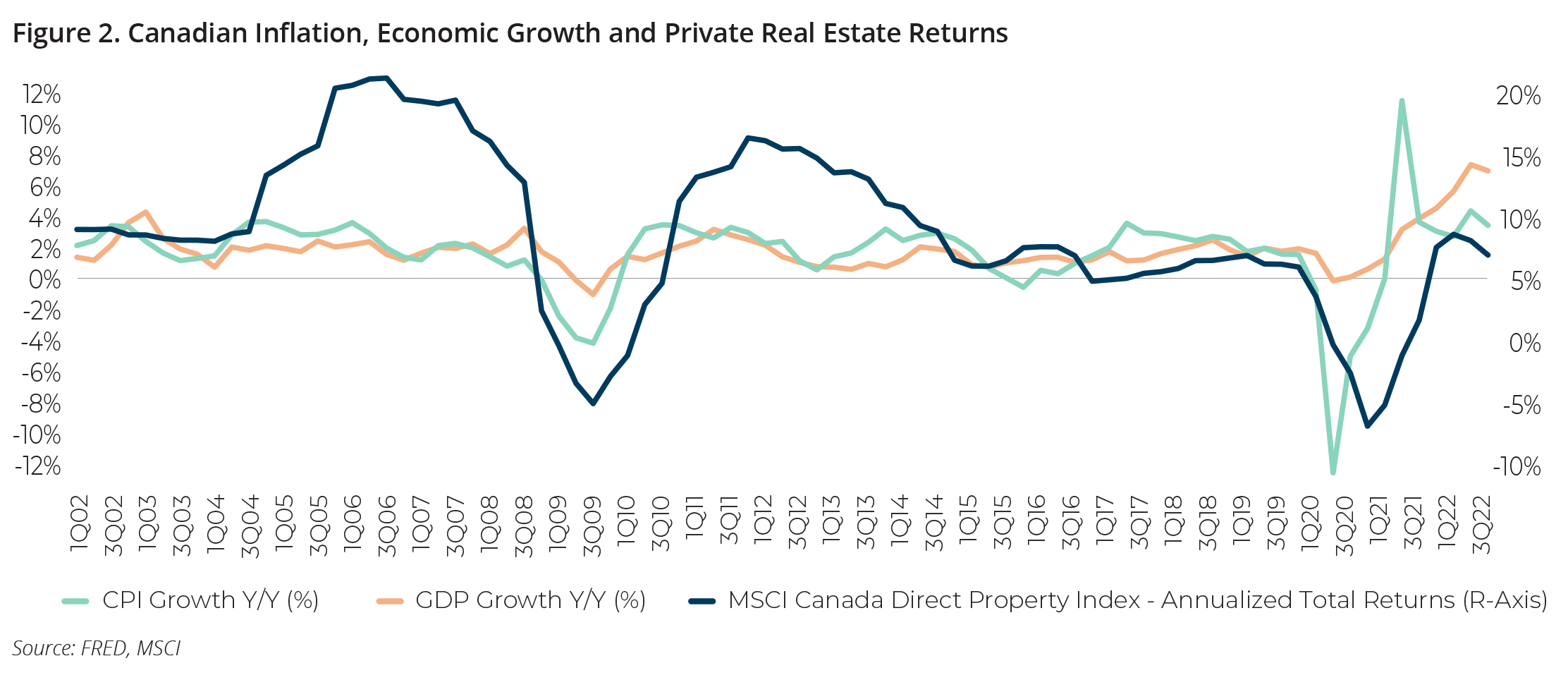

As most investors appreciate, there is an implicit relationship between private real estate and broader economic conditions—that is, a strong economy typically equals strong real estate demand and vice versa. Figure 2 shows this dynamic well. The overlay of economic growth (GDP), inflation (CPI) and private real estate returns shows the close co-movement of these metrics historically, particularly in recent years through the Pandemic (2020-2022).

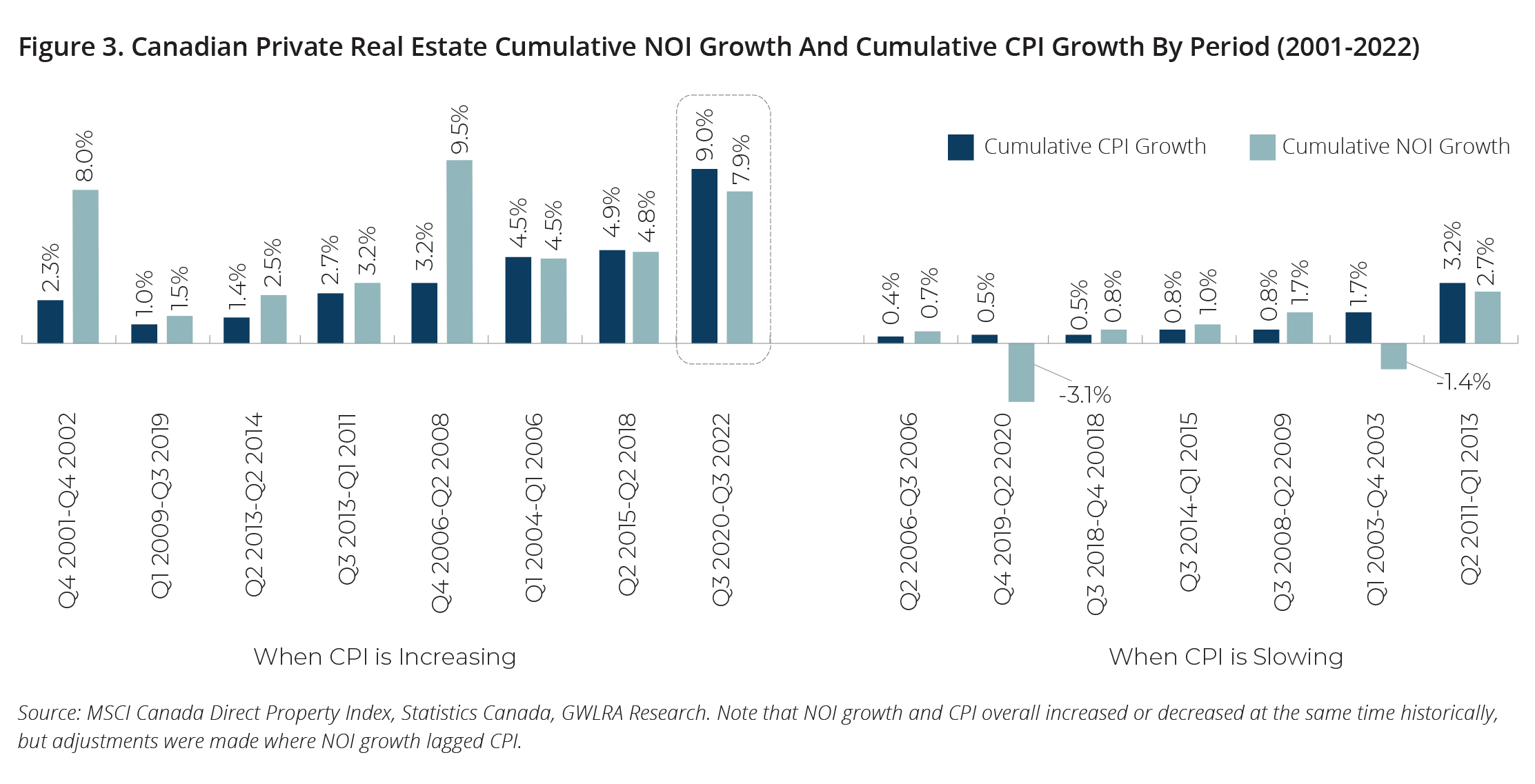

As for property cashflows, analysis also shows that income growth has kept pace with inflation. Breaking historic inflation into two distinct periods, first when it is on an accelerating trend and second when it is decelerating, property net operating income (NOI) growth is notably higher when inflation is on an upward trajectory (Figure 3). Instead of focusing on the level of inflation in and of itself (i.e., is it simply above or below historical averages), the chart also highlights the importance of trajectory.

Looking more closely at our current inflationary environment (Q3 2020 to date), property incomes have increased at comparable rate with inflation—7.9% on a cumulative basis for NOI compared to CPI at 9.0%. It must be noted that this strong income growth is driven in part by two supporting factors—'base effects’ using year-end 2020 lows as a starting point for compounding NOI growth over this period, as well as the strong growth of industrial and residential rents over the same period. Nevertheless, for those with diversified real estate portfolios, property cashflows have largely trended in line with elevated inflation levels the last 24 months.

Conversely, looking at periods of when inflation is slowing, two other themes emerge. First, NOI growth is generally lower when inflation is on the decline. Virtually all periods of slowing inflation in Figure 3 witnessed lower NOI growth compared to when CPI was on an upward trajectory. Second and more importantly, the level of inflation also appears to influence the rate of NOI growth. For example, between Q2 2011 and Q1 2013, NOI still grew 2.7% on a cumulative basis even when inflation was slowing. This was due to inflation at the time being at relatively high levels (above 3.0%), despite its declining rate of growth.

Drawing parallels to today, data suggests that inflation is starting to peak alongside rising interest rates and slowing economic growth. When leveraging the first conclusion in our analysis, this slowing rate of inflation is likely pointing to moderating income growth ahead. Even with structural demand elevated across sectors such as industrial and residential, history has shown that property cashflows are inevitably tied to broader economic and inflationary cycles, both upwards and downwards.

That said, leveraging the second conclusion from our analysis, even with inflation expected to moderate in coming quarters, it is coming off record highs at over 7.0% on an annualized basis. Consensus economic forecasts still point to inflation trending anywhere between 2.5%-6.7%[1] the next 12 months, well above pre-covid averages of 1-2%. Again, using history and data as our guide, this would suggest that property income could still see stable growth assuming the positive link to inflation and underlying economic activity.

Where we see the most near-term resilience in particular are in buildings and sectors with high occupancy rates, below-market rents, and low operating intensity. High occupancy rates support higher overall property incomes, as well as the ability to pass inflationary costs more fulsomely to tenants. Below market rents embed income growth as leases expire and ‘reset’ to higher market levels. Lastly, buildings with lower operating expenses and capital expenditures are well positioned today given continued inflationary pressures on energy, labour and material costs. For property investors, these are all critical considerations when assessing the relative strength and stability of their portfolios.

Beyond mitigating the effects of inflation, income growth also provides an important offset to rising interest rates, insulating property prices as valuation parameters shift. A topic perhaps too large and complex for this Note, we will look to explore the theme of rising interest rates in a future update.

At GWLRA we will continue to monitor the topic of inflation, including its ongoing evolution and how private real estate responds accordingly.

[1] Consensus forecasts from TD, CIBC, RBC, Bank of Nova Scotia and BMO (Q3 2022)

Research Team

Anthio Yuen

Senior Director, Research Services and Strategy

Sara Obidi

Analyst, Research Services and Strategy

Wendy Waters

Vice President, Research Services and Strategy

GWL Realty Advisors Inc. generates value by creating vibrant, sustainable communities that engage, excite and inspire. As a leading Canadian real estate investment advisor, we offer asset management, property management, development and specialized advisory services to pension funds and institutional clients. Our diverse portfolio includes residential, industrial, retail and office properties as well as an active pipeline of new development projects.