Private Real Estate: Finding Value Through Income

Amidst increasing volatility across capital markets, property investors should not overlook the importance of income.

After over two-years of pandemic-induced uncertainty, property investors faced new challenges in 2022 from elevated inflation and rising interest rates. ‘Unprecedented’ emerged as a catchphrase to define real estate markets through 2020 and 2021; for better or worse, the term remains largely appropriate today.

Property investors are concerned about potential value declines in their portfolios in the current environment of elevated inflation and interest rates. From a theoretical perspective, higher interest rates put upward pressure on capitalization (cap) rates or income yields, driving property values lower. Historical analysis however shows the relationship is varied at best—interest rate movements are inherently more volatile than cap rates making them an inadequate marker for property prices. Higher interest rates may indicate capacity for changes in property values, but little in the way of trajectory.

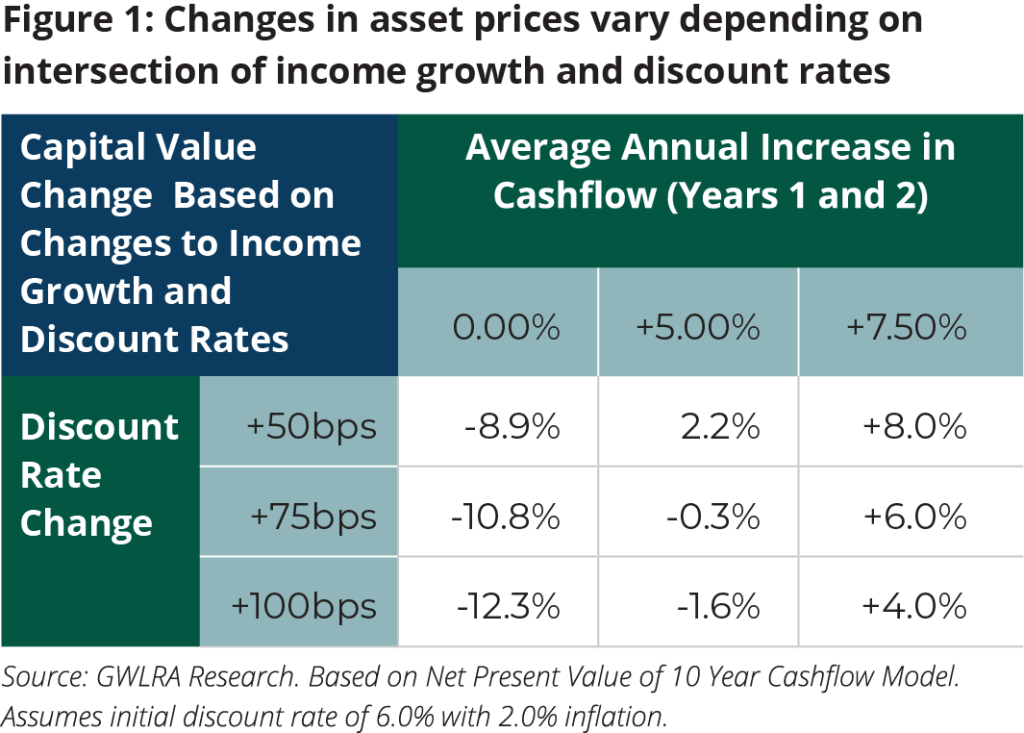

From GWLRA Research’s perspective, given property value is typically derived by discounting future cashflows, it is the interplay between changes in discount rates and changes in income growth that drive asset value—not shifts in cap rates independently.

From GWLRA Research’s perspective, given property value is typically derived by discounting future cashflows, it is the interplay between changes in discount rates and changes in income growth that drive asset value—not shifts in cap rates independently.

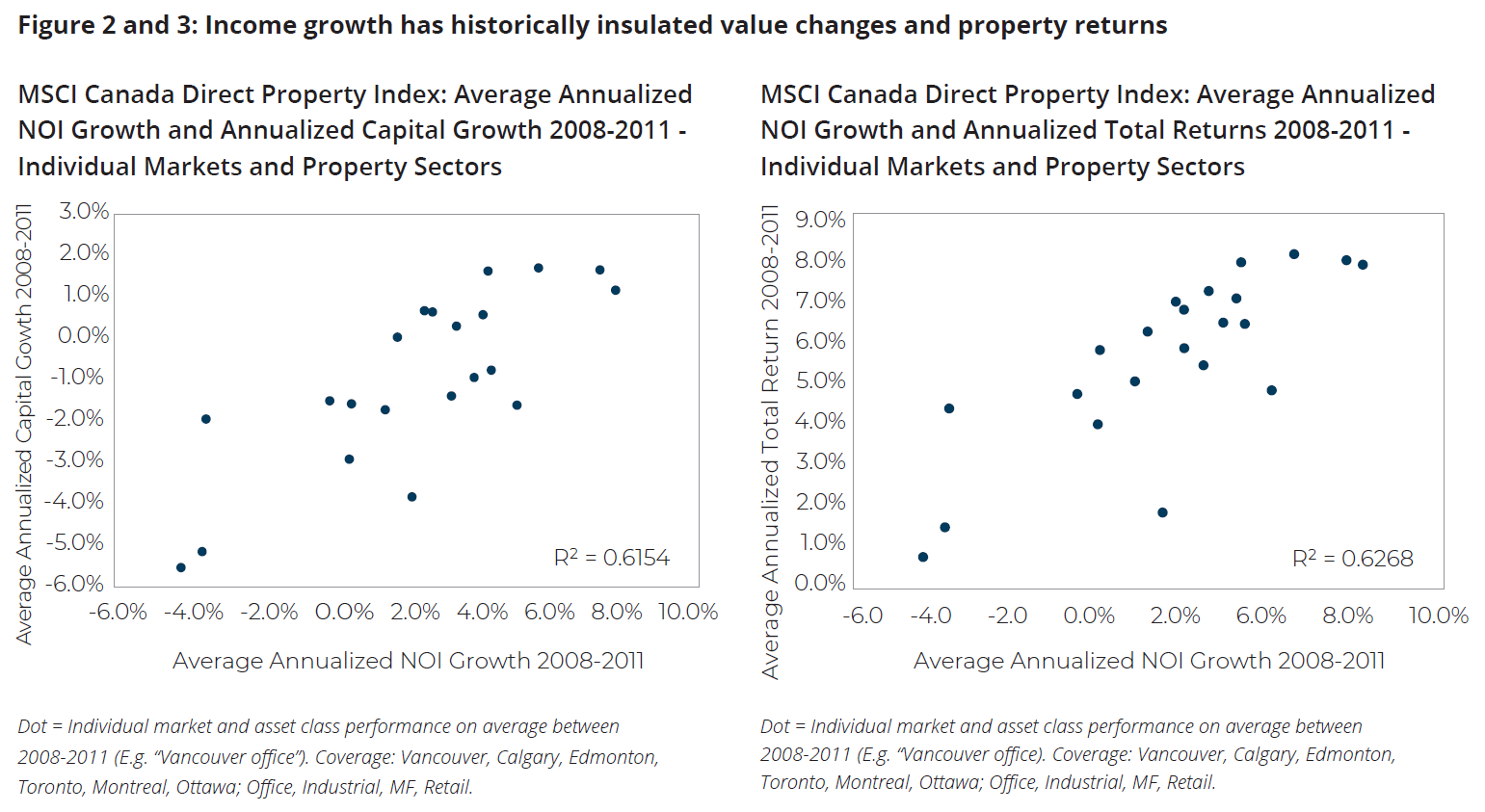

To illustrate, Figure 1 provides a simplified valuation matrix showing how property values change relative to shifts in discount rates and cashflow. A 50, 75 or 100bps increase in discount rates for example can have varying impacts on asset pricing depending on how cashflow is valued. Higher interest rates inevitably put upward pressure on cost of capital and discount rates across all investment sectors (private real estate included), but the degree to which higher discount rates impact real estate prices varies depending on treatment of current and expected income streams. Overall, assets with income growth can insulate property values from changes in discount rates (Figure 2 and 3).

Within this framework, time is another important consideration. The relative pace of growth or decline in discount rates alongside that of cashflows also has an impact on value. For example, if discount rates increase at a more measured pace, cashflow growth can provide a more substantive offset. Conversely, if shifts in discount rates are more dramatic, sizable increases in cashflow are required to limit the impact on asset values. From a strategic perspective, property investors should explore these sensitives between 1) expected and potential cashflow growth across their portfolios, and 2) the relative magnitude and pace of potential discount rate changes.

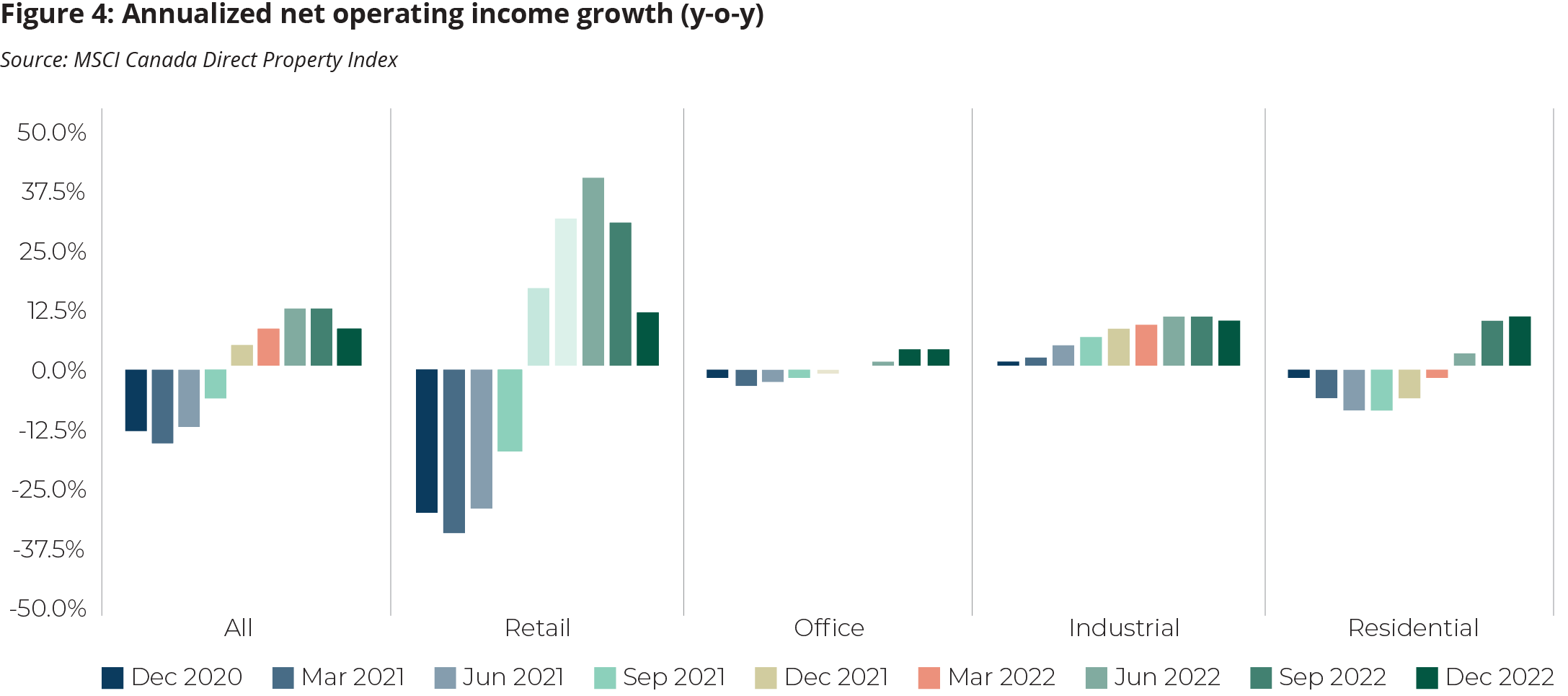

Bringing context to property income, the overall picture today is relatively positive compared to prior cycles. After volatility through the pandemic, property income growth has rebounded and is trending well above historic averages. Same store, year-over-year net operating income growth for Canadian real estate at the end of 2022 for example was 8.2%, well above 2021 levels (Figure 4). A recent Research Note shows private real estate has been one of few investment sectors to keep pace with inflation to date. Rebounding demand from the pandemic, strong population growth and elevated scarcity across most property sectors continue to drive strong cashflow growth for real estate. While there is obviously variance in performance across asset classes, purpose-built rental and necessity-based retail, alongside distribution facilities appear to have the most attractive demand fundamentals with limited availability and undersupply.

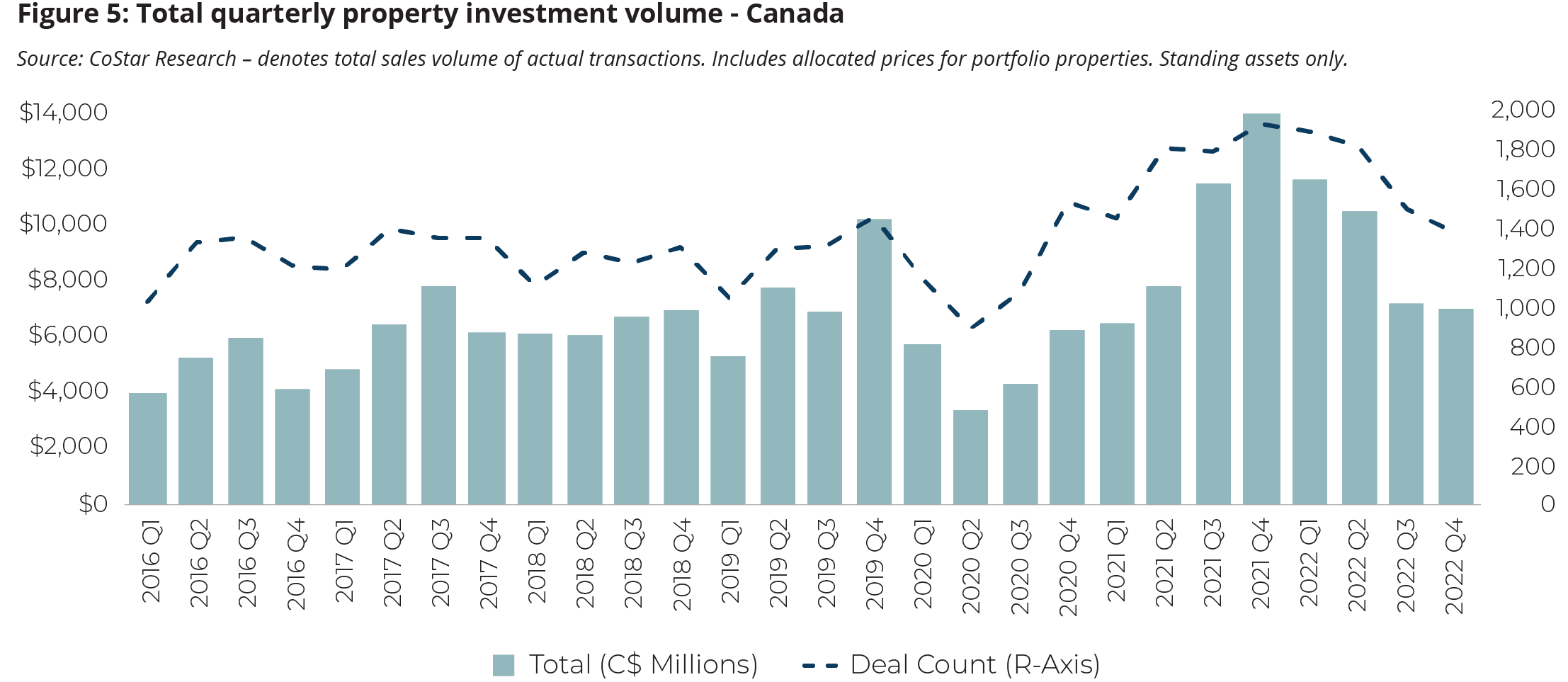

It is also important to note value transparency is made more difficult in this environment given lower levels of sales transactions. The last six months has seen limited deals as investors take a more measured approach with their capital deployment (Figure 5). The duration of this ‘wait and see’ phase will further weigh on the direction of property values alongside shifts in valuation parameters.

Overall, 2023 is expected to be framed by contrasting forces between interest rate uncertainty and the underlying strength of real estate market fundamentals. Stable income returns will likely anchor real estate performance near-term.

Investors should ultimately remember that private real estate is a ‘long-term’ asset class with returns driven by stable income growth over time. Changes in asset values (capital growth) have accounted for 35% of total property returns long-term but 80% of overall volatility.1 This contrasts to income returns which have accounted for 65% of total returns but only 20% of volatility. Securing and diversifying income streams, as well as having tactical tilts to sectors with strong income growth should be immediate focus areas for real estate portfolios. Beyond sector allocation, assets with high occupancy rates, embedded rent growth, and low operating/energy intensity should also be prioritized.

At GWLRA we will continue to monitor the topic of inflation and interest rates and the impact on private real estate performance.

1 Source: MSCI Canada Direct Property Index – based on annualized returns of Standing Investments, all assets 2000-2022.

Related reports:

Yielding Perspective: Cap Rates, Discount Rates and Relative Value for Real Estate

On the Rise: A Closer Look at Inflation and Canadian Real Estate Implications

Based in Vancouver, Anthio brings more than 15 years of experience to GWLRA’s Research and Strategy team specializing in property market analysis, applied research and portfolio strategy. He has a Master’s in Urban Planning and Development from the University of Toronto.